- Japanese

-

- A

- A

- A

BLOG

A look Back at Global Logistics in 2020 under COVID-19

- Market Analysis

2021.02.26

At the end of 2019, a new type of coronavirus (COVID-19) broke out in Wuhan, China. The infection spread rapidly around the world, profoundly impacting life in 2020.

In this blog, we look back on how the world's logistics, including seaborne trade, reacted during 2020.

Impact of Global Lockdown on Logistics

Around March 2020, as one of the measures to contain the rapid spread of the COVID-19 infection, all countries implemented a lockdown (urban blockade) at the same time. As the movement of people was restricted and there was temporary suspension of production and consumption activities in major regions of the world, various sectors of life and business were greatly affected. Maritime transportation, a key element of the global supply chain, was no exception.

At all ports people's access to the port itself and to adjacent factories was restricted, resulting in reduced utilization of port facilities, delays in cargo handling, and other disruptions in the logistics of cargo to and from the ports. As a consequence to the delays in cargo handling, many ships were held up in ports and shipping companies had to make adjustments, such as reducing the number of ships on each route in anticipation of a decrease in cargo movement due to the sharp decline in economic activity.

In particular, the volume of product transportation, which is strongly related to consumer spending, saw a marked drop in transportation volume after bottoming out in April and May 2020, and the volume of cargo movements of industrial raw material transportation (Iron ore, coal, crude oil, etc.) also slowed down. Conversely, a sharp drop in oil demand led to a buildup of inventories in crude oil storage tanks and the demand for tankers increased, not for transportation but for use as offshore oil storage facilities.

China's Early Return to Economic Activity

As the World struggled to cope with the spread of COVID-19, China succeeded in quickly containing the infection and gradually resumed economic activities around March, just as other countries entered the lockdown phase. Prior to that, around February, the supply chain had been disrupted due to the suspension of production at plants in China and delays in logistics, and the risks of a global supply chain relying on China became apparent. However, China quickly put its economy on a recovery track and resumed production, dispelling the concerns of various companies. In addition to the stagnant cargoes, China began to increase the production of new items and aggressively exported masks, quarantine products, and medical supplies.

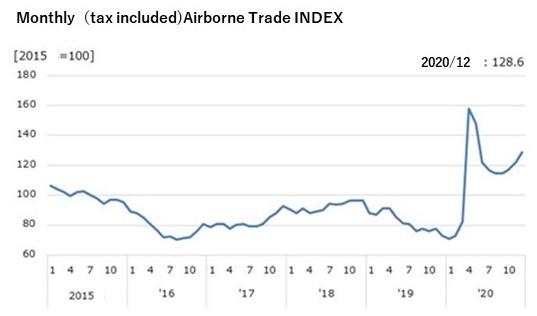

Around March -April, urgent cargoes such as masks, quarantine items and medical supplies, which had been in tight demand around the world due to the disruption of ports in other countries that were locked down, were transported by air. As a result, the demand for air cargo increased and freight rates soared.

(Around April 2020, the price rose nearly twice as much as usual.)

Strong recovery of Chinese economy

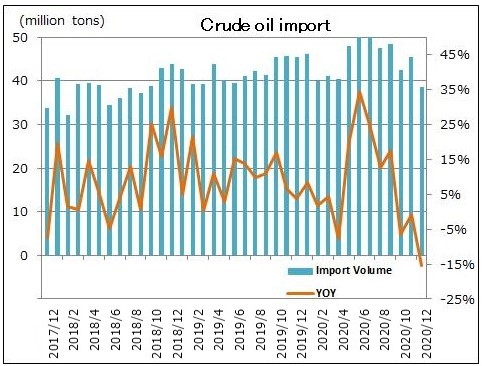

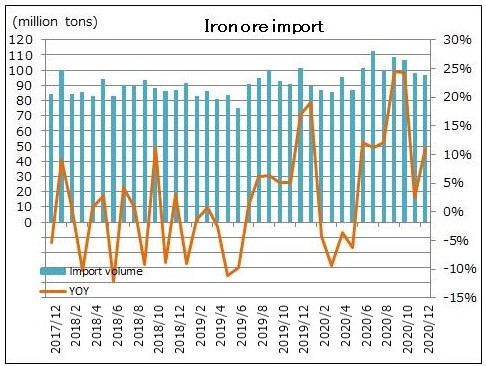

In June, cargo movements began to recover, in both product and raw material transportation, as countries gradually lifted their lockdowns and resumed economic activities. The Chinese economy, which had resumed economic activity earlier than other countries, showed a strong recovery at a pace faster than expected thanks to the government's aggressive economic support measures. By the summer of 2020, monthly imports of crude oil and iron ore reached record levels.

-

(China's imports of both crude oil and iron ore reached record highs

-

around June to August 2020.)

-

Source: Bloomberg

*Dry bulk market trends for the first half of 2020 (up to July), along with the impact of COVID-19, can be found here

Blog: What are the points that affect the bulk carrier market? Is China the key?

Background to the sharp rise in container freight rates (from China to Europe and America)

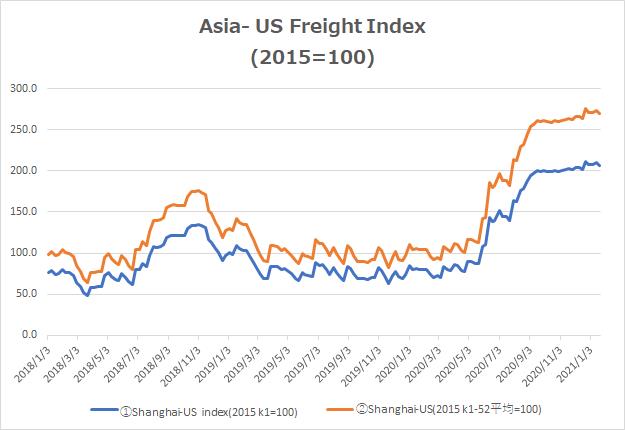

In the United States, which gradually resumed economic activity, imports of products began to move, and freight rates from Asia to North America rose beginning the latter half of June to July. The driving force for this was that supplies from Asia, which had been suspended before the Chinese New Year in February, began to move in response to the resumption of economic activity in the U.S.

Source: SCFI (Shanghai (Export) Containerized Freight Index)

The volume of imports continued to increase and remain high due to a variety of factors, such as expenditure by those staying at home (electronic devices such as personal computers, pharmaceuticals, etc.), inventory buildup by U.S. retailers, housing demand (materials, daily household goods for moving, home appliances, etc.), and the advance of the holiday season sale. Despite the COVID-19 disaster, cargo movement from Asia to North America hit a record monthly high in October. From November onward, freight rates began to rise again, spurred by a worldwide shortage of containers and logistical disruptions (intensified vessel stagnation on the West Coast of North America).

Due to the impact of soaring freight rates for North America, the amount of freight for Europe gradually increased. This was driven in part by the fact that shippers were building up inventories in preparation for the Brexit turmoil at the end of the year.

In addition to the unprecedented situation where areas of supply and demand suddenly stopped all at once, the rise in demand for products specific to the Covid-19 pandemic, repeated restrictions on behavior such as social distancing, and various other factors, all combined to create a chaotic logistics environment and eventually caused freight rates to rise.

(As of February 2021, logistic disruptions are still continuing, although shipping companies and related parties are working to restore normalcy.)

Bottom: Container freight index for Europe)

Source: Freightos Baltic Index

GDP and Cargo Movement

For a long time, seaborne cargo movements (especially containers) have been understood to correlate with GDP economic growth rates in countries around the world, with GDP taken as one of the key indicators for forecasting cargo movements. In the early stage of the pandemic, cargo movements were expected to decline substantially, in line with the decline in GDP. However, cargo movements turned out to be stronger than expected. The main reason was that although the service industry, which accounts for a high proportion of GDP, suffered a sharp decline due to restrictions on activities in response to COVID-19, goods consumption remained strong and cargo movements recovered as production activities resumed.

Although GDP will remain an important indicator of seaborne cargo movements, the pandemic has revealed that a sudden change in the lives of individuals can change their consumption behavior, creating a huge swell that affects seaborne cargo movements. Social distancing and a "stay at home" lifestyle have stimulated new demand for remote-work PCs and mobile phones, as well as housing materials and furniture, and impacted the demand for maritime transport, which accounts for the major part of international logistics.

Economic Recovery from COVID-19: Green Recovery

Countries worldwide have been faced with the delicate and difficult task of balancing economic activities with measures to contain the spread of Covid-19, and have announced a series of proactive economic stimulus measures and financial support measures. Perhaps the most notable feature of this year was the "green recovery" aimed at simultaneously solving environmental problems and recovering the economy from the effects of Covid-19. The world’s major countries have all announced their goals (declaration) to solve the climate change problem and realize a carbon-neutral society. These issues, which were thought to be "a little further ahead", have now been recognized to be an "urgent and important issue to be solved" in tandem with a recovery from the COVID-19 pandemic.

Many countries around the world have announced green recovery plans, with common policies including expanding the use of renewable energy and promoting and supporting the spread of EV use.

MOL is also actively promoting low-carbon businesses such as offshore wind power and next-generation alternative fuels, including hydrogen and biofuels. More details will be introduced in future blogs.

The year 2020 may be the year we rediscovered how precious the things we take for granted are. We expect energy, water, and essential goods for daily life to be delivered without delay. Despite the severe curtailment of the movement of people in 2020, the demand for products and resources did not cease. It can therefore be seen there will always be a need for logistics, whatever the adverse conditions societies face.

For over 130 years the MOL Group has provided safe and reliable transport for a variety of goods, including resources, energy, raw materials, and finished products. All these have supported the lives and industries of people worldwide. In order to continue fulfilling our role as an indispensable lifeline for societies, we will endeavor to remain the company of choice by customers and partners by adapting to the changing times and market conditions.

Find out more about MOL safety initiatives and transportation services at our company's corporate profile:

Writer:Masumi

She joined in 2002.She is experienced in secretary to the president, bulk carrier operations, HR division. She is in charge of the market research from 2018.Always looking forwards to finding the ways to help our service go beyond the world! Her favorite food is Japanese traditional sweets.

Recommended Articles

2022.07.05

- General Shipping

2021.04.13

- Energy

2021.08.07

- Eco Friendly

2021.06.07

- Energy

- Eco Friendly

2021.11.16

- Eco Friendly

Latest Articles

2024.04.02

- Energy

- General Shipping

2024.03.19

- Energy

- General Shipping

2024.03.05

- General Shipping