BLOG

Global CCUS Case Studies – MOL’s CO₂ Shipping Challenge (Part 2)

- Energy

- Eco Friendly

- General Shipping

2025.10.28

Worldwide various initiatives are underway to achieve carbon neutrality. In this blog, we introduce one such initiative—CCUS (Carbon Capture, Utilization and Storage) — in a two-part series.

In this, the second part, we explore the current global landscape of CCUS, Japan’s efforts in this field, the emerging topic of carbon recycling, and MOL’s participation in maritime CO₂ transport projects.

Key Points

- Rapid global expansion of CCS projects and increasing CO₂ capture capacity.

- U.S. leadership in CCS driven by policy support and infrastructure development.

- Japan’s CCS progress through demonstration projects and new legislative frameworks.

- Expanding carbon recycling applications in chemicals, fuels, and construction.

- MOL’s role in building a CCUS value chain through maritime transport and partnerships.

Global Status of CCS/CCUS

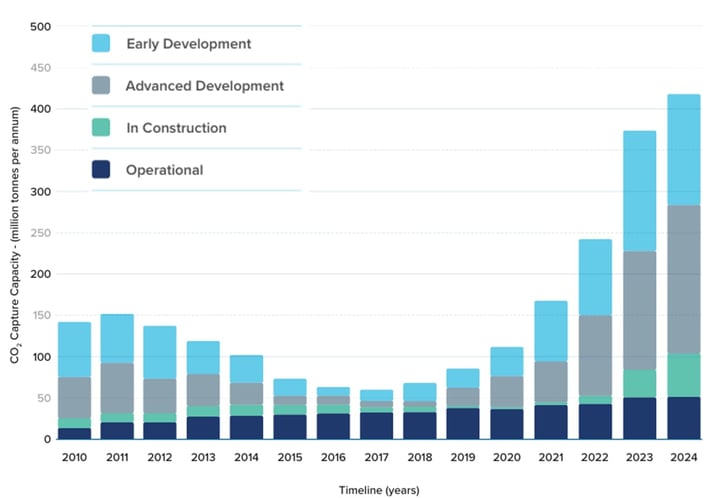

According to the Global CCS Institute (GCCSI), as of July 2024 there are 628 CCS projects worldwide. Of these, 50 are operational and 44 are under construction. The currently operating facilities capture and store approximately 50 million tons of CO₂ annually, and when including projects in the planning stage, this figure reaches 410 million tons — about seven times the scale in 2017. Given that global annual CO₂ emissions are estimated at 35 billion tons, CCS accounts for just over 1% of total emissions.

Between 2015 and 2017, many large-scale CCS projects planned in the United States and Europe were suspended or canceled due to funding challenges, lack of social demand, and insufficient policy support. As a result, interest in CCS waned during that period. However, with the global spread of net-zero targets, the necessity of CCS has been increasingly recognized. Strengthened policy support has led to a surge in new projects, with an average annual growth rate exceeding 30% in planned initiatives up to 2024.

Notably, between 2023 and 2024, 236 new projects were launched, including those in the planning phase. Regionally, the breakdown of operational and under-construction projects is as follows:

・United States: 33 (20 operational, 13 under construction)

・Europe: 15 (5 operational, 10 under construction)

・China: 20 (14 operational, 6 under construction)

・Canada: 12 (7 operational, 5 under construction)

・Middle East: 7 (1 operational, 6 under construction)

・Southeast Asia: 2 under construction (1 in Malaysia, 1 in Thailand)

While North America and Europe lead in project numbers, East Asia and the Middle East are also seeing a growing trend, raising expectations for further development in the near future.

.jpg?width=501&height=642&name=Number%20of%20CCS%20Projects%20and%20CO2%20Capture%20Capacity%20(Comparison%20Between%202023%20and%202024).jpg)

Number of CCS Projects and CO₂ Capture Capacity (Comparison Between 2023 and 2024)

Trends in CO₂ Capture Capacity of CCS Projects

Trends in CO₂ Capture Capacity of CCS Projects

(Source both above and below:GCCSI "Global Status of CCS 2024")

The United States Leading the World: Background and Future Outlook

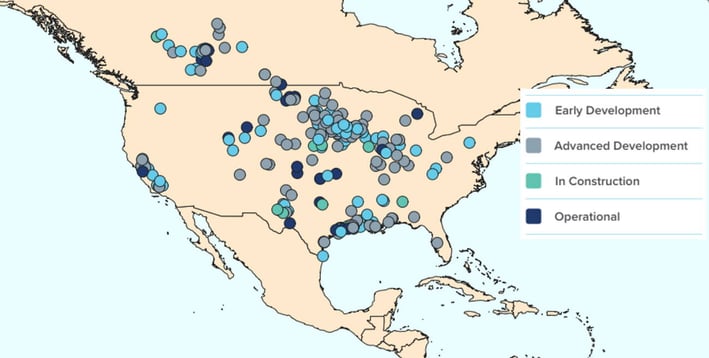

In terms of the number of CCS projects, the United States is currently leading the world in this field. In addition to the 33 active projects, including those under construction, the country is managing over 200 additional projects across its central and southern states.

(See map below)

(Source:GCCSI "Global Status of CCS 2024")

The United States already has the world’s largest CO₂ pipeline network, spanning approximately 5,150 miles (8,300 kilometers). Most of these pipelines are concentrated around the oil fields of the Permian Basin in western Texas, where CO₂-EOR (Enhanced Oil Recovery using CO₂ injection) is actively utilized. This region sees the announcement of numerous new CCS projects every year. There are three main factors behind the surge in CCS projects in the U.S.:

1. The country’s official return to the Paris Agreement in 2021, which strengthened climate policy.

2. The Infrastructure Investment and Jobs Act (IRA) enacted the same year, securing $12 billion (approx. ¥1.7 trillion) in funding.

3. The expansion of the 45Q tax credit, which incentivizes CO₂ capture and separation, allowing the federal government to effectively cover a significant portion of CCS implementation costs.

These policy drivers, combined with a growing global awareness of the need for decarbonization, have spurred investment in CCS technologies.

However, CCS in the U.S. now faces headwinds. On June 11, 2025, the Trump administration announced its intention to repeal regulations requiring CO₂ capture at thermal power plants. These regulations, introduced under the Biden administration, targeted plants operating beyond 2030 as part of its decarbonization strategy. The Trump administration criticized the rules for increasing costs. This policy shift is expected to temporarily slow CCS efforts in the U.S., and close attention will be needed to monitor future developments.

Japan’s CCS/CCUS Initiatives

So, what is Japan doing in the field of CCS?

According to the Agency for Natural Resources and Energy (ANRE), Japan has an estimated CO₂ storage potential of approximately 240 billion tons. However, building CCS facilities requires geological surveys and other groundwork, meaning this potential cannot be fully utilized immediately. To pave the way for full-scale operations, a large-scale CCS demonstration project has been underway since 2012 in Tomakomai City, Hokkaido.

.jpg?width=1200&height=797&name=%E8%8B%AB%E5%B0%8F%E7%89%A7%E3%81%AECCS%E5%AE%9F%E8%A8%BC%E5%AE%9F%E9%A8%93%20(1).jpg) CCS Demonstration Project in Tomakomai City, Hokkaido (Source: Ministry of Economy, Trade and Industry – Agency for Natural Resources and Energy website)

CCS Demonstration Project in Tomakomai City, Hokkaido (Source: Ministry of Economy, Trade and Industry – Agency for Natural Resources and Energy website)

At the Tomakomai CCS Demonstration Facilities, a cumulative total of 300,000 tons of CO₂ injection was completed in November 2019, and the site is now undergoing monitoring of storage conditions. This monitoring ensures that there are no anomalies, such as CO₂ migration or leakage to the surface.

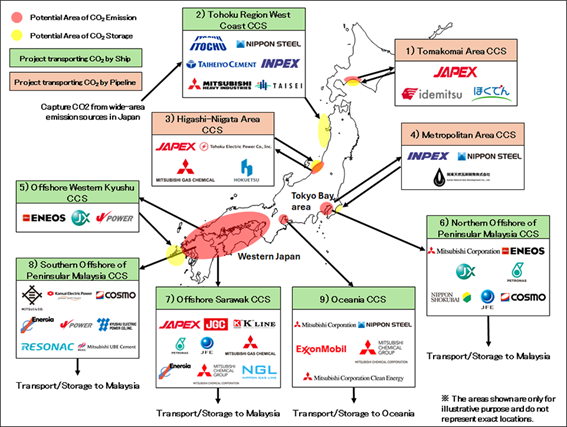

To further advance CCS, which is gaining importance in the pursuit of carbon neutrality, Japan’s government is also working on legal frameworks. In May 2024, the Act on Carbon Dioxide Storage Projects (CCS Business Act) was passed in the National Diet, making the commercialization of CCS in Japan a more realistic proposition. Under this government-led initiative, JOGMEC (Japan Organization for Metals and Energy Security) launched a public call in April 2024 for commissioned research related to “Engineering Design Work for Advanced CCS Projects.” As a result, nine candidate projects were selected — five domestic storage projects and four overseas storage projects.

Advanced Efforts for Commercialization of CCS

Advanced Efforts for Commercialization of CCS

- JOGMEC selected Nine projects as Japanese Advanced CCS Projects (Source:JOGMEC)

The nine selected CCS projects span a wide range of industries, including power generation, oil refining, steel, chemicals, paper & pulp, and cement. These projects are designed to address CO₂ emissions in regions with high concentrations of industrial facilities, such as Hokkaido, Kanto, Chubu, Kansai, Setouchi, and Kyushu. Together, the nine projects aim to store approximately 20 million tons of CO₂ annually. Of these, five projects involve domestic storage, while the remaining four are planned for storage in Malaysia and Oceania. Among them, MOL is contributing to the development of the Offshore Western Kyushu CCS Project, led by ENEOS Corporation, ENEOS Xplora Inc, and Electric Power Development Co., Ltd., by conducting a maritime transport study for CO₂ shipping.

Japanese companies possess a strategic advantage in CCS through their technological expertise across the entire value chain—from CO₂ separation and capture to storage. Given the rapid expansion of the global CCS market since 2023, Japanese firms are well-positioned to play a leading role in the development of CCS infrastructure and technologies worldwide.

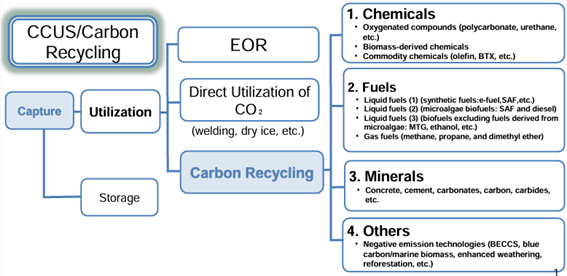

What Is Carbon Recycling?

Up to this point, we have focused on CCS/CCUS, which involves the separation, capture, and storage (and utilization) of CO₂. The EOR (Enhanced Oil Recovery) introduced earlier is a technology that enhances oil field productivity by utilizing CO₂. Another approach to reducing CO₂ emissions is to reuse CO₂ as a resource, a concept known as carbon recycling.

In Japan, the shipment volume of liquefied CO₂ (including dry ice) reached 666,000 tons in FY2024, according to JIGMA statistical data. The most common use was in welding applications, particularly CO₂ arc welding for ships, bridges, and high-rise buildings. This is followed by more familiar uses such as carbonated beverages and dry ice for cooling.

However, these applications alone limit the amount of CO₂ that can be reused. To increase the amount of CO₂ being reused, various initiatives are underway to expand its range of applications.

In June 2023, ANRE released a roadmap to accelerate innovation in CO₂ recycling, marking a significant step forward in Japan’s carbon recycling efforts.

The roadmap identifies chemicals, fuels, and minerals as key areas where carbon recycling is expected to expand. Specific examples include polycarbonate, known for its excellent processability and impact resistance and use in products such as iPhone bodies, as well as biofuels, and resources used in the production of concrete products and structures. Projects aimed at realizing these applications are underway across the globe, with many Japanese companies actively participating.

.jpg?width=800&height=513&name=Global%20Expansion%20of%20Carbon%20Recycling%20by%20Japanese%20Companies%20(2).jpg) (Agency for Natural Resources and Energy (2023): “Carbon Recycling Roadmap” — Translated by MOL)

(Agency for Natural Resources and Energy (2023): “Carbon Recycling Roadmap” — Translated by MOL)

From CO₂ Marine Transporter to CCUS Operator — MOL’s Commitment

In addition to our participation in the Offshore Western Kyushu CCS Project, MOL is actively investing in CCUS-related initiatives as part of our broader commitment to realizing a carbon-neutral society. In March 2021, we invested in Larvik Shipping AS, a Norwegian company with over 30 years of experience in liquefied CO₂ transport, thereby entering the liquefied CO₂ maritime transport business. By combining our expertise in safe vessel operation with Larvik Shipping’s industry-leading know-how, we aim to deliver optimal marine CO₂ transport solutions tailored to individual CCS and CCUS projects. We also aim to pursue business opportunities beyond maritime transport by investing in CO₂ capture and storage operations located upstream and downstream within the CCUS value chain. Furthermore, we seek to drive further business expansion by integrating CCUS with ventures related to carbon credits, onboard CO₂ capture systems, and next-generation energy solutions.

Source: Larvik Shipping AS corporate website

Source: Larvik Shipping AS corporate website

We believe that building a robust value chain to accelerate the expansion of CCUS initiatives requires close collaboration with domestic and international partners. In Japan, alongside our efforts in advanced CCS projects, we are strengthening partnerships with key industry players. Together with NYK Line, Kawasaki Kisen Kaisha, Ltd, Mitsubishi Shipbuilding Co., Ltd., Nihon Shipyard Co., Ltd., Mitsubishi Corporation, and Mitsui & Co., Ltd., we have obtained Approval in Principle (AiP) for the basic design of a low-pressure liquefied CO₂ carrier(MOL press release). This marks a significant step forward in joint development efforts. Internationally, in June of this year, we established a ship-owning joint venture with two subsidiaries of Malaysia’s national energy company PETRONAS— PETRONAS CCS Ventures Sdn. Bhd. (PCCSV) and MISC BERHAD (MISC) (MOL press release)— for the development and ownership of liquefied CO₂ vessels. Through such collaborations, we are committed to delivering cross-border decarbonization solutions. We will continue to actively participate and invest in a wide range of projects, including CCS, as part of our ongoing efforts to realize a carbon-neutral society.

Recommended Articles

2022.07.05

- General Shipping

2021.04.13

- Energy

2025.03.18

- General Shipping

2021.08.07

- Eco Friendly

Latest Articles

2026.01.20

- Eco Friendly

- General Shipping

2025.12.09

- Eco Friendly

- General Shipping

2025.12.03

- General Shipping