BLOG

Fear of food shortages impacting maritime cargo movements

- General Shipping

2022.09.13

Food prices are rising worldwide, including in Japan, and there are concerns about the spread of serious hunger, especially in the Middle East and Africa.

In this blog, I will explain the situation regarding grain exports from Ukraine, which is seen as one of the main causes for this situation, and its impact on maritime cargo movements.

Ukraine, “Food basket of the world”

Ukraine is a country located in Eastern Europe with an area of about 600,000 square kilometers, about 1.6 times that of Japan. It became independent in 1991 following the breakup of the Soviet Union. Under the former Soviet Union, Ukraine was responsible for military industries such as steel, shipbuilding, and aerospace, as well as grain production, especially wheat, in the division of labor within the federation. Grain production continues to play an important role in the current Ukrainian economy.

Agriculture, one of the major industries in Ukraine, is sustained by the presence of local black soil known as Chernozem, one of the most fertile types of soil in the world. About 60% of Ukraine's soil is made up of this black soil, which is of such good quality that it is said that the Nazi troops who invaded during World War II tried to carry it away in wagons. About 70% of the country is covered by agricultural land, totaling 41.31 million hectares, which is about 10 times greater than agricultural land in Japan.

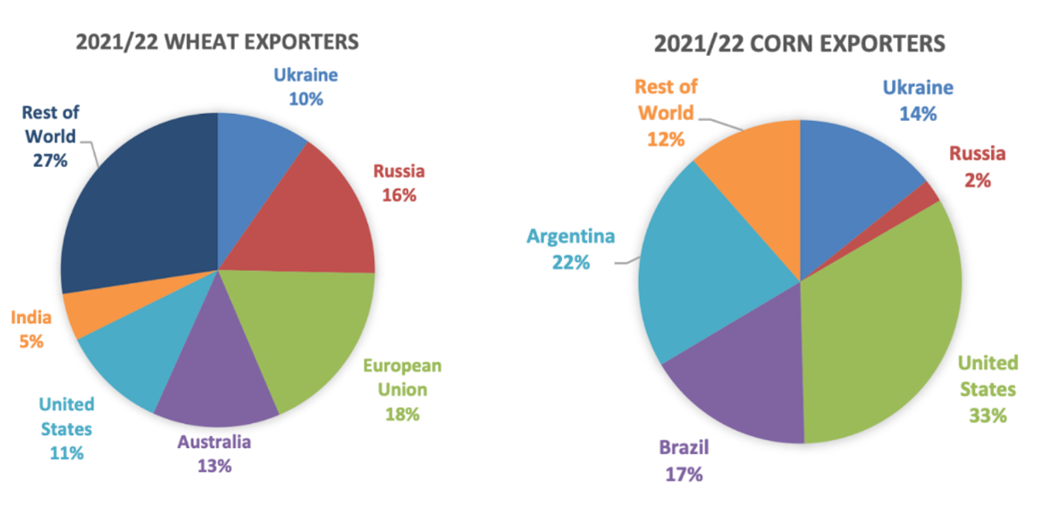

The agriculture, forestry, and fisheries industries account for 9.3% of Ukraine's GDP, with agricultural exports totaling $27.8 billion, which is 41% of total exports (2021). Ukraine was once known as "Breadbasket of Europe" as the grains grown in Chernozem soil were exported to Europe, but today it is known as “Food Basket of the World”, exporting its agricultural products to Africa and Asia. According to the U.S. Department of Agriculture (USDA) statistics, wheat accounted for 10% of exports and corn for 14% in 2021/2022.

It is said that the blue of the Ukrainian flag represents the sky and the yellow represents wheat.

Source:USDA Grain World Markets and Trade

Impact of Black Sea blockade on exports

Following the invasion of Ukraine, the Russian government blocked ports on the Black Sea, and since 24 February 2022, no ships had called at Ukrainian ports in the Black Sea. Over 90% of Ukrainian crops were previously exported from three ports in the Black Sea, including southern Odessa, and the Black Sea blockade has forced them to take alternative routes, such as by railway on the western border or by the Danube River. This has severely limited the volume being transported and as a result more than 25 million tons of grain, about half of the country's annual exports, remained in Ukraine.

In response to growing international criticism that the Black Sea blockade has caused food shortages around the world, particularly in the Middle East and Africa, on 13 July Russia and Ukraine agreed to open a corridor for grain exports in the Black Sea, with the mediation of the UN and Turkey. The first cargo ship to resume exports of Ukrainian grain from the Black Sea, the Lazoni, left bound for Lebanon on 1 August with about 26,500 tons of corn. However, Lebanon refused to receive the cargo due to delays in arrival. Although some cargo was sold and unloaded in Turkey, the vessel is still navigating without a destination carrying more than 25,000 tons of cargo. When the corridor first opened, most of the cargo ships that sailed were previously stranded vessels that left with their cargo. Most of the cargo was corn for feed and ethanol production, all of which seemed to have been stored in warehouses for more than five months. Despite managing to finally leave port safely, they stood the risk of having their cargo refused on quality grounds. In addition, congestion is also expected in the Black Sea due to the need for additional escort ships and others, and it is expected that it will continue to be necessary to transport the cargo by railway, as well as via the Danube River and from ports in neighboring countries such as Romania and Moldova in order to handle the large amount of cargo that remains.

Impact on maritime cargo movements

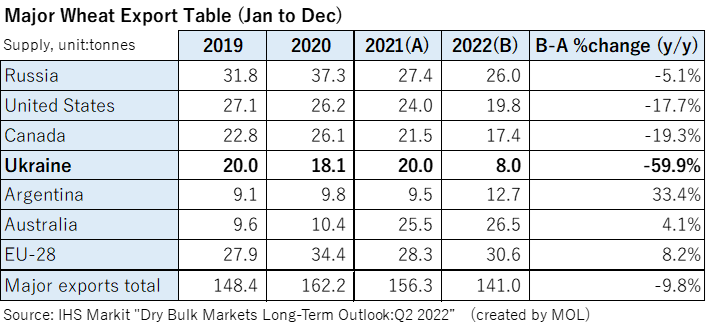

IHS Markit reported on 30 May that wheat exports from Ukraine in 2022 are expected to fall by 60%, a drop to 8 million tons from 20 million tons in 2021, while the EU and Australia, which have been having a good production year and are expected to increase their exports. However, the overall total global exports are likely to fall by 9.8% to 141 million tons from 156 million tons the previous year.

Many Middle Eastern and African countries with low economic power are importing Ukrainian wheat, despite its low quality, due to its low cost. Global trade flows are unlikely to change significantly, as it is not easy for such countries to switch to other domestic products which are more expensive.

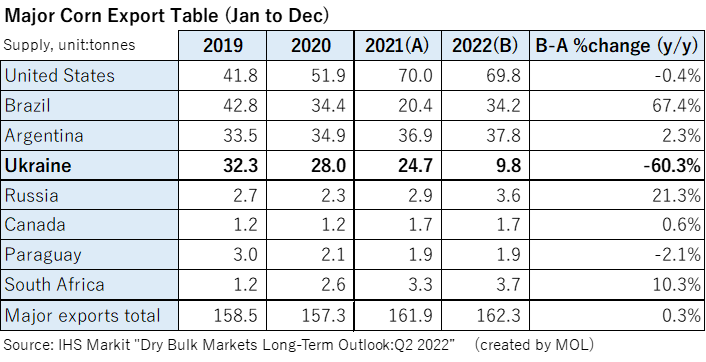

For corn, exports from Ukraine are expected to fall by 61%, while world exports will likely increase slightly by 0.3% with a 67% increase in exports from Brazil, which is expected to have a good harvest.

China, which has been a major importer of Ukrainian corn, is paying for U.S. corn for the time being. However, an agreement was reached with Russia in February to expand wheat imports and a quarantine requirement was resolved in May to allow imports of Brazilian corn, which may lead to an increase in alternative procurement from these two countries.

Similarly, there are speculations that the EU, which has also been importing Ukrainian corn for feed, would switch to Brazilian corn, and future trade trends need to be monitored closely.

Situation in Russia

Russia has stopped publishing detailed monthly trade statistics. However, the U.S. Department of Agriculture (USDA) estimates that Russian wheat will have good harvests in 2022 and 2023 and exports are expected to increase by 21% to 40 million tons.

The number of ship arrivals and departures at the Russian port of Novorossisk on the Black Sea has kept to the same level as before the invasion, and according to local reports, exports remained at 2.6 million tons as of April, a slight increase from the normal level (according to the Ministry of Agriculture, Forestry and Fisheries). For background, the variable export taxes, which were above $100/ton at the end of June, have been changed to rubles after July and are expected to be cheaper in dollar terms. Also, the export quota of 8 million tons of Russian wheat has been lifted, which had been in place until June. It is expected that the Middle East, Africa, China, and other countries that have not implemented economic sanctions on Russia will continue to import in a straightforward manner.

Fertilizer shortage - Growing concern over food shortage

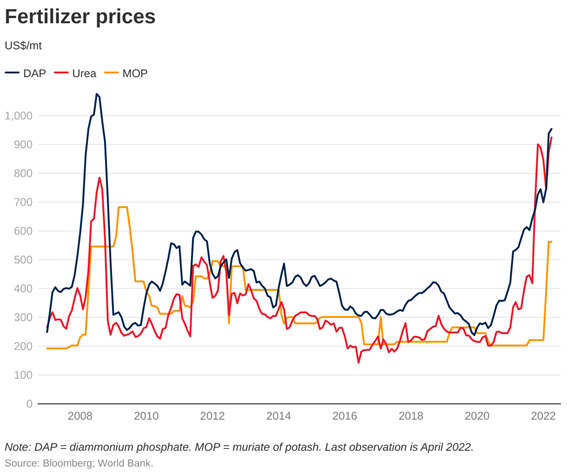

The food problems caused by the Russian invasion of Ukraine are not limited to reduced grain exports from Ukraine, but also to reduced fertilizer exports from Russia and the increase in fertilizer prices due to a lack of supply.

Phosphate, potash, and nitrogen are the three major fertilizers, and they are essential for modern agriculture. Russia exports nearly 20% of the world's nitrogen fertilizer and, together with its sanctioned neighbor Belarus, accounts for 40% of the global potassium export share. Fertilizer prices have skyrocketed and have become difficult to obtain because of the sanctions imposed by the West and Russian export controls.

Many countries known for exporting agricultural products, such as Brazil and the EU, have relied on imports from Russia for fertilizers. In addition, some countries do not export agricultural products but rely on imports of fertilizers for domestic consumption. The fertilizer problem affects all agriculture worldwide and threatens to reduce all food production, not just wheat and corn.

Source:

https://blogs.worldbank.org/opendata/fertilizer-prices-expected-remain-higher-longer

Countries are rushing to secure alternative sources, release stockpiles, and set export controls to protect their own food supplies, but some estimate that hunger could increase 5-fold to 160,000 people in the Middle East, where it is difficult for countries to be self-reliant.

UN Secretary-General Antonio Guterres has warned that if food produced by Ukraine and fertilizers made by Russia and Belarus are not supplied to international markets normally, "we will face fear of a global food shortage."

MOL has developed "Lighthouse," a service aimed at dry bulkship customers who transport bulk goods, such as wheat and corn, that allows those involved in the transport process, such as shippers and vessel operators, to safely, unitarily, and in real time, share and monitor various kinds of information related to ocean transport, such as vessel schedules ,weather, ocean conditions, as well as data related to cargoes and contracts, on a customized basis for each customer.

A document outlining this service is available for DOWNLOAD here.

For the concept of the platform, please see the video below.

Writer:Mai

Joined MOL in 2014 after working for a foreign shipping company and 2 years stay in Shanghai, China. After being in charge of operating bulk carriers for about 4 years, now I’m involved in development and promotion of “Lighthouse”, a portal site for dry bulk customers, in the marketing department since April 2019. We aim to stay close to customer's perspective and develop the user friendly service. Weekly yoga is my precious break time.

Recommended Articles

2022.07.05

- General Shipping

2021.04.13

- Energy

2025.03.18

- General Shipping

2021.08.07

- Eco Friendly

Latest Articles

2026.01.20

- Eco Friendly

- General Shipping

2025.12.09

- Eco Friendly

- General Shipping

2025.12.03

- General Shipping