BLOG

Critical minerals essential for decarbonization

- General Shipping

2023.09.11

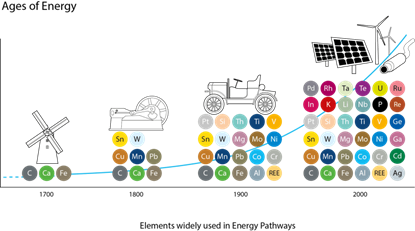

Mineral resources are becoming increasingly important around the world as industrial sectors decarbonize to achieve carbon neutrality by 2050.

Mineral resources are essential for the manufacture of electric vehicle (EV) storage batteries and motors, as well as power generation facilities and storage batteries for renewable energy such as wind, solar and geothermal energy. The amount of mineral resources required is said to be six times greater for EVs than for fossil fuel vehicles, and nine times greater for onshore wind power plants than for natural gas-fired power plants.

Among mineral resources, critical minerals include lithium, cobalt, and nickel, which are required for EV storage batteries and renewable energy facilities, and whose demand in the drive for decarbonization is rapidly increasing. There is no clear definition of what constitutes a critical mineral, and it varies from country to country and year to year. For example, the USGS (U.S. Geological Survey), a U.S. government agency, listed 50 Critical Minerals in the United States in 2022.

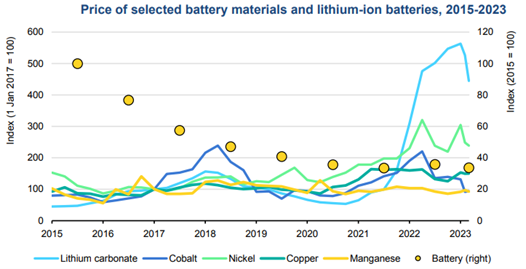

The rapid adoption of EVs from 2020 to 2022 led to a surge in demand for critical minerals, resulting in higher prices. In 2022, the prices of nickel, cobalt, and lithium soared to double, 2.5 times, and 8-9 times their 2015 levels, respectively, due to supply chain disruptions caused by the spread of the COVID-19 and Russia's invasion of Ukraine. In the beginning of 2023, prices were on a downward trend against a background of strengthening global production and a slowdown in demand for EVs in China. However, according to the IEA, if the 2050 net-zero scenario is to be realized, demand for nickel can be expected to increase by 2 times, cobalt by 3 times, and lithium by 13 times compared to 2021. In the future, the price of critical minerals may rise again if EV sales increase in each country and the supply chains are disrupted due to unexpected circumstances.

(Source: IEA “Global EV Outlook 2023”)

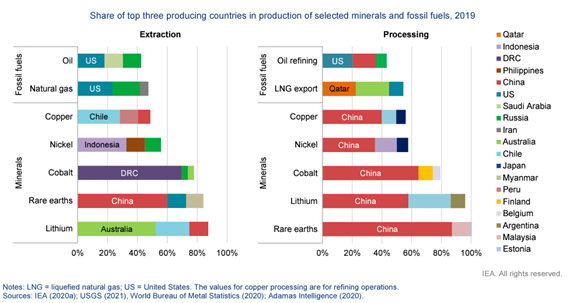

Critical minerals are produced by countries with a relatively high geopolitical risk: 70% of cobalt is unevenly distributed in the Democratic Republic of Congo; 20% of high-grade nickel is produced in Russia; and 60% of rare earths are produced in China. Furthermore, the processes for refining and processing these resources are almost exclusively concentrated in China, which is a serious concern for Western countries wary of China's dominant position and its geopolitical ambitions.

In addition, China, which has restricted exports of rare earths in the past, now controls exports of gallium and germanium, while Indonesia, the largest producer of nickel, has banned exports in order to prioritize domestic supply.

Countries that extract (produce) and

process (refine and process) various resources

(Source: IEA “Global EV Outlook 2022”)

Therefore, industries are developing technologies and products that are less dependent on critical minerals, as well as recycling technologies.

International Partnership for Stable Supply and Demand

In order to secure a stable supply of critical minerals, countries are moving to conclude partnership agreements.

In October 2022, Japan reached an agreement with Australia on a Partnership for Critical Minerals. Japan also promoted resource diplomacy with resource-rich countries such as Africa and South America to strengthen cooperation. In December of the same year, Japan announced a partnership with the Democratic Republic of Congo.

In a broader cooperative framework, the Minerals Security Partnership was launched in June 2022 at the initiative of the United States. In addition to the U.S., the main members are the U.K., France, Germany, Canada, the EU, Australia, Finland, Norway, Sweden, South Korea, and Japan, with the aim of strengthening the critical minerals supply chain.

Technology development in industry

Utilization of Urban Mines

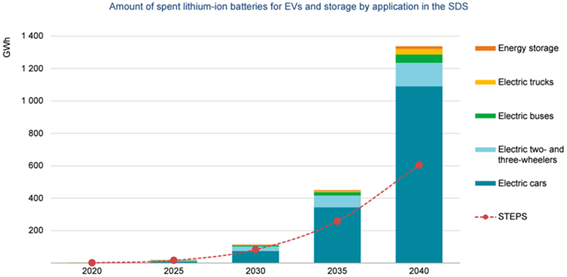

In Japan, where resources are scarce, important minerals are extracted from a variety of discarded products, such as home appliances and automobiles, and recycled. These have been called "urban mines" in anticipation of them becoming an important alternative source for natural resources. At a time when concerns about the stable supply of critical minerals are intensifying, research and development on mineral resource recycling technologies are underway worldwide, and the recycling of used EV batteries, which are relatively large and widely used, is an urgent issue.

In Europe, the European Commission of the European Union mandated that 12% of cobalt, 4% of nickel, and 4% of lithium battery materials be derived from recycling by 2030, partly from the viewpoint of environmental protection.

The number of used EV lithium-ion batteries and

storage batteries will rapidly increase from around 2030.

(Source: IEA “The role of critical minerals in clean energy transitions”)

Reduction of usage and development of alternatives

In addition to technological developments aimed at reducing the use of critical minerals and eliminating dependence on importing countries, we are also developing alternatives that can fulfill similar roles without relying on critical minerals.

In Japan, the Ministry of Economy, Trade and Industry (METI), the Ministry of Education, Culture, Sports, Science and Technology (MEXT), the New Energy and Industrial Technology Development Organization (NEDO), and other organizations are promoting research and development of technologies to produce components that can perform the same functions as rare earth magnets used in EVs and renewable energy equipment without the need for rare metals, through commissioning and subsidizing private companies, universities, research institutes, and others. We are also promoting research and development of technologies that can be used by automobiles, materials, and chemical manufacturers, who themselves are pursuing R&D on their own.

Creation of new sources of supply

Research and development to find new sources of mineral resources are also underway. The Japanese government has started to develop mining technology for rare earth mud in the deep waters of the Ogasawara Islands, Minamitorishima, and plans to start prospecting in 2024. There are 4 major marine mineral resources (Submarine hydrothermal deposits, cobalt-rich clasts, manganese nodules and rare earth mud) in the ocean, each of which contains different metals. Around Minamitorishima there is a considerable amount of mud containing high concentrations of rare earths on the ocean floor at a depth of 5000~6000 meters. If it is possible to mine mineral resources on the sea floor in this area, it will be of great significance to Japan, which relies on imports for the most part, and is attracting high interest both at home and abroad.

Real challenges reflected in critical mineral issues

As described above, in order to ensure that critical minerals meet rapidly increasing demand, the public and private sectors around the world are working to establish (1) stable procurement through partnerships with supplier countries; (2) develop recycling technologies to extract minerals from end-of-life products; (3) development of substitute materials; and (4) development of new sources of supply such as undersea-mines.

On the other hand, as pointed out in the Energy Technology Perspective 2023 published by the IEA in January 2023, while it is important to switch to clean power sources by promoting electrification and renewable energy, efforts should not be neglected to reduce energy demand itself. Although decarbonization can be achieved with clean power sources, the minerals that support it are also natural resources. According to the report, by maintaining EV range rather than increasing it from the current level, the battery capacity of EVs will be 20 ~ 25% less than what the IEA expects to achieve net 0 between 2030 and 50, and the use of mineral resources will be reduced by 20%. The IEA notes that it is therefore important to change fundamental consumer behavior, such as the greater use of public transportation for long-distance travel and the effective use of individual EVs through car-sharing.

Recently, it has been pointed out that the lock-in of limited resources among friendly countries increases environmental and human rights risks. Therefore, it is important to comprehensively assess the risks of critical minerals, from development to distribution.

Now, in the face of the absolute mission of decarbonization, countries and companies are scrambling to secure supply destinations and requirements under the scenario that demand for critical minerals will continue to increase significantly in the future. However, the IEA seems to be showing the importance of doubting the premise of this scenario and returning to the basic principle that decarbonization is for the environment.

Securing a reliable means of transportation is essential to realize a stable supply chain for critical minerals. With the world's largest fleet of bulk carriers, MOL Dry Bulk offers a wide variety of vessel types to flexibly accommodate various trades around the world and provide high-quality transportation services.

The MOL group is also actively engaged in the development and research of next-generation fuel carriers to contribute to the reduction of GHG emissions during transportation.

Writer:Mai

Joined MOL in 2014 after working for a foreign shipping company and 2 years stay in Shanghai, China. After being in charge of operating bulk carriers for about 4 years, now I’m involved in development and promotion of “Lighthouse”, a portal site for dry bulk customers, in the marketing department since April 2019. We aim to stay close to customer's perspective and develop the user friendly service. Weekly yoga is my precious break time.

Recommended Articles

2022.07.05

- General Shipping

2021.04.13

- Energy

2025.03.18

- General Shipping

2021.08.07

- Eco Friendly

Latest Articles

2026.01.20

- Eco Friendly

- General Shipping

2025.12.09

- Eco Friendly

- General Shipping

2025.12.03

- General Shipping