BLOG

Dry Bulk Commodity Trade in India

- General Shipping

- Market Analysis

2024.08.09

India, officially the Republic of India, is a country in South Asia. It is the seventh-largest country by area, the most populous country as of 2024. India is surrounded by the Indian Ocean in the south, the Arabian Sea in the southwest and the Bay of Bengal in the southeast, boasting a mainland coastline extending 5,422 kilometers.

Indian economy is now experiencing rapid growth and the government have ambitious plans. Despite significant challenges in the global environment, a World Bank update in April 2023 highlights that Indian economy has demonstrated resilience, positioning it as one of the world's fastest-growing.

Beyond its growth trajectory, India has pledged to achieve various sustainability goals. The Maritime India Vision (MIV) 2030, designed to propel the nation to the forefront of the global maritime sector within the next decade, includes initiatives for the development of eco-friendly ports and environmentally conscious shipping practices.

This article will explore the recent economic advancements in India, the progress of infrastructure development, the Maritime India Vision, the noteworthy Indian major ports, current trade patterns, and the prospects of dry bulk commodity trade in India.

India Emerges as a Key Player in the Global economy:

- ✔ India is expected to become the third-largest economy in the world with a GDP of $5 trillion in the next three years and touch $7 trillion by 2030 on the back of continued reforms, the Finance Ministry of India said on 29th Jan 2024.

✔ World Economic Forum (WEF) President, Borge Brende expressed optimism about India's economic growth, stating that the country is on track to become a USD 10 trillion economy in the coming years and will secure the third-largest slot globally.

- ✔ IMF - world economic outlook, July 2024, projects India's growth to be 8.2% in 2023 and will remain strong at 7.0% in 2024 and 6.5% in 2025.

✔ "The government has, however, set a higher goal of becoming a 'developed country' by 2047. With the journey of reforms continuing, this goal is achievable," the Indian government said.

India Investing in Infrastructure and Ports:

✔ India is looking forward for a substantial growth in its infrastructure sector over the next 25 years to realize its goal of becoming a 'Developed Nation' by 2047.

✔ The Central Government has launched Gati Shakti program with a vision to bring under one umbrella, all the major mobility infrastructure projects of various ministries and state governments, such as Bharatmala (roads & highways), Sagarmala (a string of ports), inland waterways etc..

✔ The Indian government has crafted the Maritime India Vision (MIV) 2030, with the objective of strengthening the country's ports, shipping, and waterway sectors through coordinated interventions.

✔ ‘Safe, Sustainable and Green Maritime Sector’ is one of the focus areas under the MIV (Maritime India Vision).

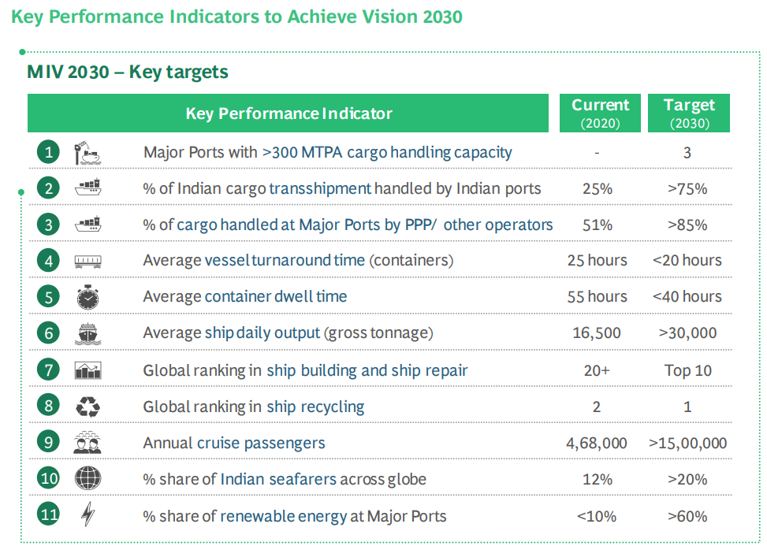

Following are the Key Performance Indicator of the Maritime India Vision (MIV) 2030 by the Ministry of Ports, Shipping and Waterways.

Source: MARITIME INDIA VISION 2030

Major Ports of India

India has 12 major ports and over 200 non-major ports in the country, along the 5,422 km long coastline. Vadhavan Port in Maharashtra, which is under construction, would be the 13th major port in India.

Source: The chart is created based on port latitude and longitude information from Wikipedia.

Following Ports are the Major Drybulk Ports of India in terms of Drybulk cargo load/discharge of year 2023.

Source: AXSMarine

India Emerges as a Key Player in the Global Dry Bulk Trade:

In Year 2023, India achieved the second spot in the import country ranking for dry bulk commodity trade, registering a significant import trade volume of 359 MMT and demonstrating an impressive consistence growth rate of 13.4% in Year 2022 and 8.64% in Year 2023 (based on international trade volume).

Source: AXSMarine

India Dry bulk commodity trade – Iron Ore:

In the year 2023, India experienced remarkable advancements in the export and import trade of Iron Ore, showcasing substantial growth. The country achieved an impressive export growth of 165% and a noteworthy import growth of 137%. The export volume reached 44 MMT, while the import trade reported 5.2 MMT (based on international trade volume).

Source: AXSMarine

India Dry bulk commodity trade – Coal:

✔ With the world's fifth-largest coal reserves, India holds the position of the second-largest coal consumer, driven by its rapidly expanding economy. The power sector, is witnessing a compounded annual growth rate (CAGR) of approximately 7.5% from FY 2021-22 to 2023-24, and other sectors are also contributing to the surge in coal demand.

✔ In overall coal consumption spectrum, the unavailability of Coking coal and high-grade Steaming coal in India necessitates imports to meet the requirements of industries like steel etc. However, medium and low-grade Steaming coal are abundantly available domestically, making it imperative for the country to sufficiently produce and fulfill domestic demand.

✔ According to the Ministry of Coal, the anticipated figures for the fiscal year 2024-25 indicate that domestic coal production is expected to reach 1111 MT, while the estimated domestic demand is projected at 1290 MT.

✔ The International Energy Agency (IEA) forecasts a yearly growth rate of 3.5% in India's coal demand till the year 2026.

Historically, India has been importing a significant quantity of both Steaming coal and Coking coal. According to AXSMarine's report of the year 2023, India's imports of Steaming coal and Coking coal reached 173 MMT and 68 MMT respectively, showing growth rates of 6% and 7%. India export minor amount of coal to countries like China, Vietnam etc. (based on international trade volume).

Source: AXSMarine

India Dry bulk commodity trade – Minor bulk commodities:

In addition to coal and iron ore, India imports a moderate volume of fertilizer, limestone, petroleum coke, gypsum, manganese ore, bauxite and steel products from various countries like USA, Russia, Oman, South Africa, UAE, China etc.

In the export side, apart from iron ore, India exports a moderate volume of commodities such as salt, steel products, sugar, cement, aluminum and more to countries like UAE, Bangladesh, Vietnam, USA, China, South Korea etc.

In addition to international transportation, there is a substantial volume (e.g. 76 MMT in year 2023) of domestic movement involving Steaming coal, Iron Ore, and Cement originating from the eastern region of the country, primarily facilitated through the ports of Paradip, Visakhapatnam and Gangavaram.

India's Dry bulk commodity Imports in 2023 – Trade Partners:

India’s key import partners are Indonesia, Australia, Russia, South Africa, UAE, USA, Oman, Mozambique etc.The country Imports:

- ・Steaming Coal: Mainly from Indonesia, South Africa, Australia, Russia, and the USA.

・Coking Coal: Primarily from Australia and Russia.

・Other Commodities:

-Gypsum and limestone from Oman

-Petroleum coke from the USA

-Manganese ore from South Africa

-Limestone from UAE

-Bauxite from Guinea

-Fertilizer from Jordan

- ・Steaming Coal: 98 MMT from Indonesia and 25 MMT from South Africa respectively.

- ・Coking Coal: 37 MMT from Australia.

- ・Limestone: 23 MMT from the UAE.

(based on international trade volume)

Source: AXSMarine

India's Dry bulk commodity Exports in 2023 – Trade Partners:

On the Export side, India’s key Export partners are China, South Korea and USA.

The country Exports:

- ・Iron Ore: Mainly to China.

・Salt: Primarily to USA.

・Other minor exports:

-Salt to Japan, Bangladesh, Indonesia, Qatar, Taiwan etc.

-Granite to China

-Corn to Vietnam

-Baryte to USA, Saudi Arabia

India's notable dry bulk commodity export volumes for 2023:

- ・Iron Ore: 25 MMT Iron Ore Fines, 8 MMT Iron Ore Pellets, 7 MMT Iron Ore to China

・Salt: 5 MMT to China.

(based on international trade volume)

Source: AXSMarine

As India continues to invest in infrastructure, focusing on the development of ports, transportation networks and technological integration for enhancing the efficiency and competitiveness of the dry bulk trade sector, the future of dry bulk trade in India is promising, laden with opportunities.

Example of MOL's Project in India : MOL and Tata Steel explore GHG emissions reduction technologies to deploy an environment friendly bulk carrier

"India's economy has performed well and stronger-than-expected data in 2023 has caused us to raise our 2024 growth estimate to 6.8% from 6.1%. India is likely to remain the fastest growing among G20 economies over our forecast horizon" Global rating agency Moody's said in its Global Macroeconomic Outlook for 2024.

The substantial import and export quantities of commodities like coal, iron ore, and steel products underscore India's pivotal role in the global trade network. This suggests a subtle change in India's trade dynamics and emphasizes its evolving role in the global economic landscape.

Writer:Pulak Ranjan Nath, Principal Data Analyst, MOL-IT India

Hello, I'm Pulak Ranjan Nath, a Principal Data Analyst at MOL-IT India, and a member of the Artificial Intelligence and Data Science (AID) team. With over 15 years at MOL-IT, I bring extensive experience in data analytics, particularly in the shipping domain. Currently, I am contributing to the Dry Bulk BI Project, where I explore Dry bulk shipping market data, generate meaningful business insights, and define key correlations. Additionally, I am involved in the Environment and Sustainability project, focusing on analytics related to CO2 emissions, CII ratings, and the EU ETS. As a Computer Science engineer and a Certified BI Professional, I am dedicated to leveraging data to drive innovation and sustainability in our business.

Recommended Articles

2022.07.05

- General Shipping

2021.04.13

- Energy

2025.03.18

- General Shipping

2021.08.07

- Eco Friendly

Latest Articles

2026.02.02

- Eco Friendly

- General Shipping

2026.01.20

- Eco Friendly

- General Shipping