BLOG

Review of the Dry Bulk Market in 2023 and Outlook for 2024

- General Shipping

- Market Analysis

2024.02.06

As the world moves toward economic recovery following the COVID-19 pandemic, we have been unable to accurately track the trends in the dry bulk market owing to factors such as the restriction of access to the Panama Canal due to extreme weather conditions and the difficulty of using the Suez Canal due to tensions in the Middle East, both of which have forced changes in shipping routes. In this article, we will discuss cargo movements and dry bulk market trends for each ship type in 2023, and the market forecast for 2024, taking into account the Panama Canal situation, which is experiencing its worst drought in 100 years.

Click here for a discussion on trends in the bulk carrier market from early 2020 through to the end of July.

→How the bulk carrier market has been affected by COVID-19. Is the key China?

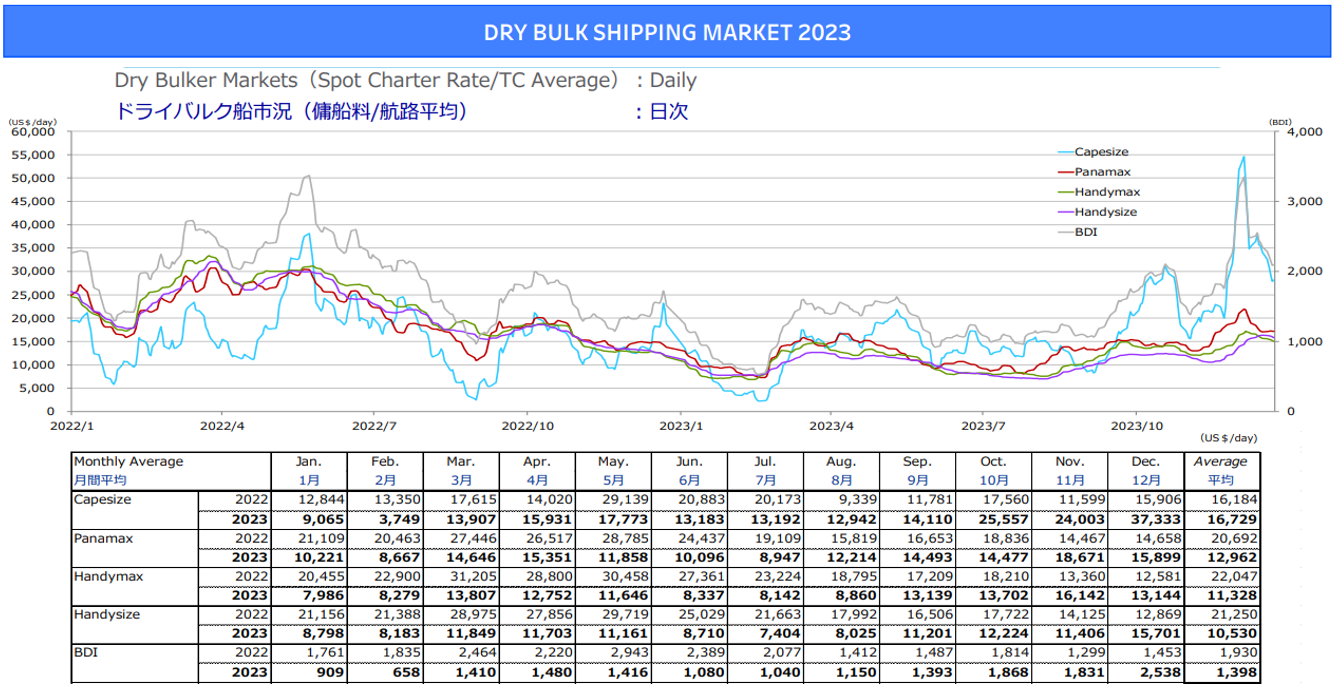

Dry Bulk Market Features in 2023

The dry bulk market in 2023 saw a significant recovery towards the end of the year for all ship types, but overall it remained at a lower level than expected throughout the year. Although the movement of major cargoes such as iron ore and coal remained relatively robust, we believe that the deterioration of market sentiment due to factors such as the delay in China's economic recovery and the uncertainty of its timing, in addition to the expected normalization of ship utilization rates due to the end of the COVID-19 crisis, weighed on market conditions more than the actual situation.

Source: MOL internal calculation based on Clarksons Research

Source: MOL internal calculation based on Clarksons Research

Overview of Cargo Movements and Market Trends for Each Vessel Type

・Capesize:

The shipment of iron ore and coal, the main cargoes for Capesize, has been robust, and China's crude steel production in 2023 has maintained the same level as in 2022. With the easing of industrial regulations due to the economic reopening after COVID-19, imports of iron ore are gradually recovering.

In addition, the demand for aluminum in China is increasing due to the steady growth of industries related to electric vehicles and renewable energy. As a result, the import of bauxite, the raw material for aluminum, from Guinea in West Africa has been increasing year by year, exceeding 100 million tons in 2023. On the other hand, the market was sluggish in the first half of the year due to the resolution of the ship congestion in China that had built up during the COVID-19 pandemic, and the improvement in ship dispatch efficiency.

Entering the second half of the year, the market rose on account of the recovery of bauxite shipments following the end of the rainy season in West Africa. From late November onwards, factors such as delays in the movement of ships due to bad weather in the Atlantic, limited ship capacity supply from the Far East, and an increase in spot cargoes of iron ore from Brazil and bauxite from West Africa led to a sharp rise in the market, with the Atlantic region taking the lead.

・Panamax

The movement of coal and grain, the main cargoes for Panamax, remained robust. For grain, the season for shipments from the East Coast of South America, such as Brazil and Argentina, where a good harvest was expected, began around March. Normally this would lead to a chain reaction of rising markets in the Atlantic and Pacific. However, in 2023, delays in grain harvesting from spring to summer resulted in a prolonged period of thin shipments. This limited the impact on the market compared to previous years, and the disappointment from the high expectations for a good harvest contributed to the market slump from May onwards. Even after that, with no clear outlook for China's economic recovery and some observations of deterioration, there was no trigger for a market reversal, and the market remained sluggish until around August. From November onwards, restrictions on passage through the Panama Canal due to water level issues boosted sentiment in the overall dry bulk market. The robust movement of coal from the East Coast of North America and grain from South America, as well as some cargo shifting to Panamax due to the soaring Capesize market, contributed to a significant recovery in the market.

・Supramax/Handysize

The main cargoes for Supramax/Handysize are food and infrastructure, among others. While they were affected by the slowdown in the Chinese economy, they remained solid, supported by transport demand due to economic growth in India and Southeast Asia, although they were more sluggish than expected. Although the market was sluggish from early spring to autumn, like Panamax, the Panama Canal issue greatly contributed to the market recovery from November onwards. The trend to choose alternative routes such as the Suez Canal began to spread, and in particular, Supramax was hit directly by the Panama Canal issue on the US Gulf grain route, which had the largest freight fluctuation during the period of highest demand. This led to a surge in the Atlantic market and also drove the Pacific market.

Outlook for the Dry Bulk Market in 2024

The dry bulk shipping industry has faced many challenges since the COVID-19 pandemic, including geopolitical changes, a slowdown in the Chinese economy, and decarbonization goals, but we expect it to remain generally strong.

The volume of maritime cargo movements is expected to continue to increase and remain robust, led by iron ore shipments from Australia and Brazil. In addition, since the Panama Canal issue is not expected to be resolved at least until early spring, the normalization and deepening of alternative route selection will increase ton-miles, and the overlap with the grain season on the East Coast of South America is expected to contribute to the stability of the market at high levels. On the supply side, many shipyards have their shipbuilding docks filled with ship types other than dry bulk ships until 2026, and the uncertainty about the future of the world economy as well as a cautious stance towards decarbonization have limited new orders, resulting in continued weak supply pressure. Given these factors, we believe that the fundamentals are generally robust and there are many other factors that will positively affect the market from both the demand and supply sides of ship capacity. Let's take a closer look at the possible positive and negative factors.

〇Positive factors:

・In addition to maintaining the high level of iron ore shipments, there is an increase in bauxite transport demand due to China's robust demand for aluminum.

・As well as the increase in demand for steaming coal, mainly used as fuel for power generation, in China and India, there is a global increase in demand for steaming coal due to the surge in energy prices caused by geopolitical risks.

・The increase in the average age of ships, leading to retirements from major trades, the limited number of new ship deliveries, and the increasing demand for ship quality, mainly from Western Australian shippers, are limiting the actual supply of ship capacity.

・The increase in ton-miles due to the choice of alternative routes caused by the water level problem in the Panama Canal. (However, whether this will be a factor throughout the year needs to be closely monitored. Please also refer to the last paragraph).

・The introduction of new rules such as EEXI/CII/EU-ETS will lead to the standardization and deepening of slow steaming, and the selection of operable ships, reducing the supply of ship capacity.

・The order of new dry bulk ships is at historically low levels of about 7% for all ship types, and the supply of ship capacity from new delivery is expected to be limited for the time being.

・The premiumization of the Middle East route due to the increase in geopolitical risks.

〇Negative factors

・Despite the high and stable iron ore prices, the continued slump in steel prices and the decrease in the desire to produce crude steel in Chinese mills lead to a decrease in the import volume of iron ore and coking coal, which is generally sticky coal mainly used as a raw material for steelmaking.

・The reduction in the decrease in ship supply capacity due to the lack of progress in the scrapping of old ships.

・The dulling of the desire to purchase fuel as well as the decrease in the desire to produce due to the soaring fuel prices in a global inflation environment, and the concerns about an economic recession.

・Further delays in Chinese economic recovery due to real estate crisis and conflicts with Western countries.

・The normalization and instability of the decrease in cargo demand due to the long-term inflation trend caused by the invasion of Ukraine (Russian sanctions), and the continued state of constant instability in the recovery of the world economy.

・Further instability in the Middle East situation and an increase in geopolitical risks (deterioration).

Panama Canal Situation

Source: Bloomberg

The Panama Canal issue, which continues to impose transit restrictions due to a record drought, is expected to cause chaos for the next few months as Panama enters the dry season (usually from December to May). The Panama Canal Authority has announced a policy of gradually reducing the number of transits per day until February 2024, raising concerns about further global logistics impacts. Although the Panama Canal issue is a factor that tightens supply and demand, it is not expected to lead to extreme market surges as a whole as it does not stop the movement of ship capacity between Atlantic and Pacific Ocean by choosing alternative routes, unlike the worsening ship congestion in major ports including China during the COVID-19 pandemic. However, with the cost burden increasing due to booking fees and auction slots for Panama Canal transit, and many shipowners changing routes to the Suez Canal and Cape of Good Hope for economic rationality, it is believed that the increase in ton-miles will have a relatively long positive impact on the market. From July to November 2022, about 70% of cargo from the US Gulf to Asia was transported via the Panama Canal, but when looking at the results from July to November 2023, it has dropped to 19%. Now there is a movement to avoid the Red Sea and further rerouting around Cape of Good Hope will increase ton-miles and the ship capacity situation may remain tight. Therefore, we will need to continue to pay attention to the situation of the Panama Canal and the geopolitical issues which may affect the Dry Bulk market .

Recommended Articles

2022.07.05

- General Shipping

2021.04.13

- Energy

2025.03.18

- General Shipping

2021.08.07

- Eco Friendly

Latest Articles

2026.02.02

- Eco Friendly

- General Shipping

2026.01.20

- Eco Friendly

- General Shipping