BLOG

How the bulk carrier market has been affected by COVID-19. Is the key China?

- Market Analysis

2020.11.02

The global spread of the new coronavirus (COVID-19) has had a significant impact on seaborne trade trends of all types of vessels, such as;dry bulk carriers, tankers, containerships, and car carriers.

Let's look back on the dry bulk market trends from the beginning of 2020 to the end of July, along with the impact of COVID-19, and consider possible future trends based on this.

* Click here for the impact on the tanker market:

[Blog] Why tanker market has dramatically increased under COVID-19

Various factors that have had an impact

COVID-19 was first detected in China in January of 2020, and since then the infection has spread worldwide, with no signs of containment. Now, a second wave of infections appears to be hitting some countries. However, even prior to the pandemic, there were a number of factors that could affect the dry bulk market.

Financial market participants were expecting 2020 to be more or less the same as 2019, despite a variety of uncertainties, including the future of the U.S.-China trade war and the impact of the Global Sulfur Cap(*) on the market, but COVID-19 upended those expectations.

(*) On and after 1 January 2020, the MARPOL permitted limit for sulphur content in ship bunker fuel oil was reduced from 3.50% mass by mass (m/m) to 0.50% m/m for ships operating outside designated mission control areas. Under the new regulation, ships are required to use heavy fuel oil with low sulfur content or install equipment to remove sulfur.

Market was plummeting before COVID-19

As of January 2020, the market for large, 180,000-tonne Capesize bulkers, mainly transporting iron ore and coal, plummeted from $11,976 at the beginning of the year to $3,973 by the end of January 2020, with other vessel types also dropping significantly across the board. Why was this?

In fact, annually from the beginning of the year to the beginning of the Chinese New Year, dry bulk cargo movement slows down and the market tends to fall. This year, however, this period was plagued by more extreme weather than in previous years.

The market was impacted by port closures in Brazil and Australia, two major iron ore loading ports, due to inclement weather conditions which halted shipments and ultimately led to a slowdown in the market. Heavy rains in Brazil, which had continued since December 2019, and Cyclone ‘Heidi’ in Western Australia hit key ports in these two countries. The resulting impact on these two major exporting countries was to have a significant detrimental effect on market conditions.

In the meantime, the spread of COVID-19 in China became apparent and the market environment began to change around the time Wuhan entered lockdown on 23 January leading to February dry bulk shipments to China becoming lower. This was immediately followed on 25 January, 2019 by the Brumadinho dam collapse. The dam was owned by VALE SA, Brazil's leading resources company (based on Axs Dry AIS data and the following cargo movement data). This caused Capesize bulker prices to temporarily drop to a low $2,000 level, with other vessel types also lower over the same period across the board.

(Dry Bulker Market) Prices fell by about one-third in the month of January 2020 due to bad weather in major iron ore loading ports in Brazil and Australia. The market remained low in February due to COVID-19 but recovered in line with China's recovery, with all vessel types returning to an upward trend from mid- to late-May.

V-shaped recovery of China's economy

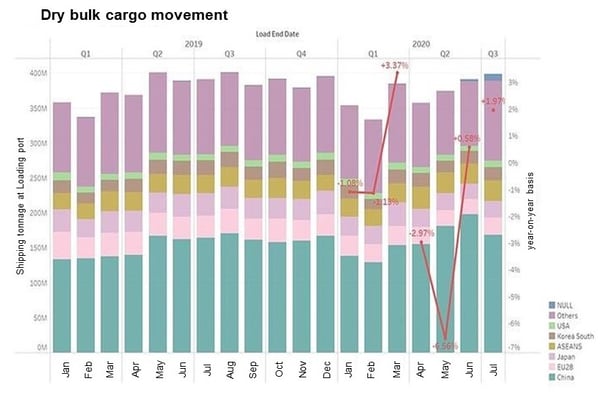

While most of the world continues to be anxious about the unimpeded spread of the COVID-19 infection, with no clear future in sight, China has become one of the first countries to contain the spread of COVID-19 and its economic activity has shown a V-shaped recovery. The manufacturing PMI announced by the National Bureau of Statistics in February fell to a record low of 35.7, but rapidly recovered to 50.2 in March. Crude steel production also recovered to 74.8 million tonnes in February (+4.97% year on year(y/y)) and 79.0 million tonnes in March (-0.17% y/y), surpassing last year’s figure for this period. Looking at the total for the first quarter (January-March), the volume of major dry bulk commodities such as iron ore, coal, soybeans, and bauxite shipped to China increased compared to the same period last year, and despite the COVID-19 pandemic, the volume of all commodities also increased by about 4% compared to the same period last year. Dry bulk cargoes (for non-China) did not show a significant decline, -1.6% y/y.

Despite the continued impact of COVID-19, the Dry bulker market for all types of vessels bottomed out in mid-February and recovered through March, in line with the recovery in China. In addition, from mid- to late-May, the Dry bulker market rose for all types of ships. Shipping companies will only gain momentum to scrap old ships after they have made their last profit under favorable market conditions. This tendency to defer scrapping vessels will lead to an awkward situation where scrapping will not proceed even after countries have eased their lockdowns.

The impact of the global spread of COVID-19

The COVID-19 epidemic spread rapidly in Europe and the United States around mid-March and each country entered a lockdown one after another. Restrictions on movement in countries that account for the majority of the world's GDP had an immediate and direct impact on demand for products, including fuel for automobiles, airplanes, and other transportation equipment, and consumer durables. Transportation demand and markets have also undergone changes that are markedly different from major events of the past, such as the Lehman shock.

In April, dry bulk cargoes to major importing countries, excluding China, declined noticeably. In the second quarter (April-June), cargo movements (on a sailing basis at the loading port) to major dry bulk importing countries, such as the EU countries including the UK (-30.0%), Japan (-21.4%), and India (-44.9%), decreased significantly across the board. Total dry bulk movements for non-China were down 14.5% on a y/y basis, and the shrinking economic activity in various parts of the world due to the spread of COVID-19 also negatively impacted dry bulk transportation demand. In mid-March, after the market had recovered, the downward trend started again for all vessel types, causing the market to suffer a double-dip recession in late April and mid-May.

(Trends in the bulker market: the market bottomed out twice, in February (following the impact of the Chinese outbreak) and May (following the impact of the global outbreak).

BDI: Baltic Dry Index, an index calculated and published by the Baltic Exchange in London, is a comprehensive index of freight rates for ocean-going tramp vessels (ships carrying grain, mineral resources and other cargoes). It is a guideline for international sea freight rates and allows us to understand the frequency of sea transportation on a daily basis. It has attracted attention because it is considered a leading indicator of the global economy and commodity prices.

Bulk carrier market supported by China in the first half of 2020

Despite the uncertain outlook for the market, cargo movements to China (customs-clearance basis) began to increase for many commodities in June. Many commodities, led by iron ore, recovered to over 100 million tonnes for the first time since December 2019, resulting in a 14.0% increase in the second quarter (April-June) compared to the same period the previous year. As a consequence, the decrease in worldwide dry bulk cargo movements was only -3.0% y/y. It can be therefore be said that China alone supported the entire dry bulker market, a country that is heavily dependent on raw fuel imports.

Regarding shipping capacity supply, there was a temporary stagnation in scrapping. The South Asian countries of India, Bangladesh and Pakistan, where more than 90% of the world's scrapping volume is concentrated, entered into lockdown at the end of March, and scrapping was largely slow in April and May despite the sluggish market. In June, these countries eased their lockdowns and the volume of scrapping recovered to normal levels, but the dry bulker market began to rise for all vessel types from around mid-to-late May, which did not mesh with the lockdown period in the dry bulker market. We can therefore conclude that the early containment of the infection in China and the spread of infections in South Asian countries resulted in the early recovery of new ship completions and the stagnation of scrapping, which negatively affected the shipping capacity supply. However, orders for new-ship-buildings have fallen, and it is certain that the expansion of supply will be controlled up until 2022. That being so, it leaves open the possibility of a positive impact on the market in the medium term.

Fluctuations in crude oil prices during the COVID-19 pandemic

Looking at crude oil prices, the sharp drop in people's mobility due to the COVID-19 pandemic has caused the crude oil price to plummet to the point where WTI (West Texas Intermediate) *went negative in April. Although the OPEC-plus massive coordinated production cuts caused an upward trend, crude oil and bunker prices were sluggish, and the price gap between higher-priced fuels that comply with sulfur emission regulations (Sox regulations) and conventional oil that does not comply with these regulations has narrowed to about $70. The bunker price market trend, which had been the primary concern of dry bulker marketers, has diminished as a factor influencing the market.

*WTI Crude Oil (West Texas Intermediate) One of the leading crude oil price indexes in the West Texas region.

*HSFO: high-sulfur heavy oil 380cSt, LSFO: low-sulfur heavy oil with 1.0% sulfur content

Key to Dry Bulker Market Recovery

During the two months from mid-to-late March to mid-to-late May, all major dry bulk importing countries except China were in a hard lockdown and there was a noticeable decrease in cargo movements caused by the suspension or contraction of economic activities. It began to appear that the battle against COVID-19 would be protracted, so many countries introduced policies to ease the lockdown gradually and in parallel resumed economic activity. This led to dry bulk cargo movements beginning to recover from around June. Dry bulk shipments to countries other than China also recovered in July to the same level as the previous year.

Along with this, although the timing and degree of the market varies for each ship type, the market turned to an upward trend from around the middle of May and has recovered to BCI 5TC = $18,296 as of the end of July.

However, cargo movement to major importing countries such as Japan, EU countries, and India (dry bulk cargoes) is still negative y/y, and the dry bulk market is still in a state of being dependent on China. In particular, the pace of recovery of cargoes to Japan (-25.8% y/y in July) and EU countries (-20.9% y/y) is slow, and if the pace of China's imports declines in the future, this will undoubtedly have an adverse effect on the market.

It is no exaggeration to say that the future direction of the dry bulk market will depend on trends in China's dry bulk imports, and it can also be surmised that China's presence (level of dependence) in the dry bulk market, which was high to begin with, will only increase as the COVID-19 infection spreads.

What will happen to the bulker market in 2021?

Market conditions are considered to be in a landing phase with minor ups and downs, but the current social situation suggests that no country is likely to enter another hard lockdown unless there is a significant outbreak of infection. If China's import trends maintain their current momentum and demand for transport to other major countries gradually recovers, the dry bulker market could ride an upward trend towards the end of the year.

Considering the stagnation in new shipbuilding orders, if there is no major second wave of COVID-19 infections, there may be a positive sign of a surprisingly quick return to a medium- to long-term recovery trajectory.

However, the above scenario is based on a case of "ifs" and the dry bulker market remains exposed to a variety of uncertainties, with the COVID-19 pandemic only increasing the level of uncertainty. The external environment surrounding this market will need to be monitored more closely. We can only hope that the global spread of COVID-19 will be brought under control as soon as possible and that society will return to a place where people can live and work safely.

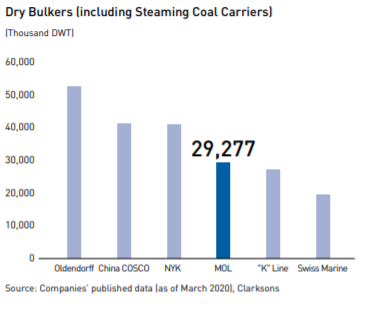

(MOL Dry Bulker Fleet Composition (Number of ships))

Writer:Ryuji Iwasa

Joined in 1993. Stationed in the United States from 1998 in the bulk carrier business. After returning to Japan, worked in the LNG shipping department and led the accounting system project at the headquarters. Currently, engaged in research on all aspects of the dry bulk business. An excellent reputation for his stable work backed by a wide range of experience and deep insight. His life work is all things baseball-related including coaching a local youth baseball team.

Recommended Articles

2022.07.05

- General Shipping

2021.04.13

- Energy

2025.03.18

- General Shipping

2021.08.07

- Eco Friendly

Latest Articles

2026.02.02

- Eco Friendly

- General Shipping

2026.01.20

- Eco Friendly

- General Shipping