BLOG

Why the tanker market was boosted by COVID-19

- Market Analysis

2020.10.28

As the impact of COVID-19 becomes more serious, we are reminded of what happened more than 40 years ago. In Japan, following the oil crisis in 1973, there was a similar irrational behavior like excessive hoarding of toilet paper and tissues caused by social turmoil. In this blog, we would like to look at the impact of COVID-19 in the demand and transportation of crude oil, refined into various types of fuels and raw material for petrochemical products.

Crude oil prices have gone negative!

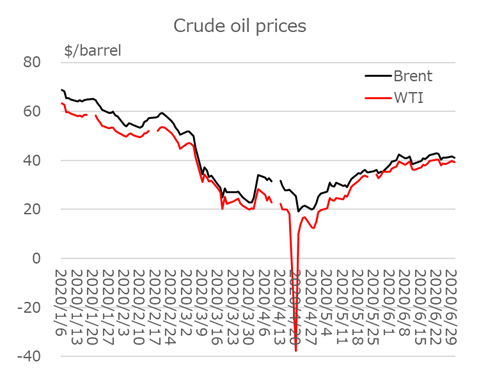

It may be fresh in your memory that on 20 April 2020, the closing price of a certain trade of WTI (West Texas Intermediate) crude oil*, the benchmark for international crude oil trading in the New York market, became negative for the first time in history, at -$37.63.

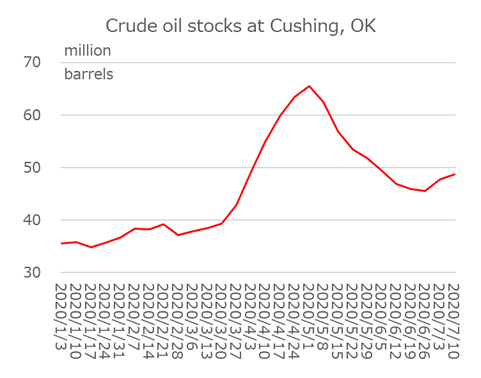

A negative price is an abnormal situation where the sellers of crude oil are willing to pay to have it taken back. The main reason for this was that the crude oil storage tanks at Cushing (the largest oil hub in the U.S., located in Oklahoma) became nearly full because the COVID-19 pandemic drastically slowed the consumption of crude oil that had been stored there. As the storage capacity of crude oil approached its limit and the cost of using the tanks soared, and sellers were willing to pay for someone to take the crude oil off from their tanks. (WTI futures trading involves physical delivery of crude oil.)

(You can see that crude oil stocks rapidly built up in April.)

(Crude oil price dived at the same time as stocks built up.)

* One of the representative benchmarks of light sweet crude oil produced mainly in Texas.

Oil demand and supply gap

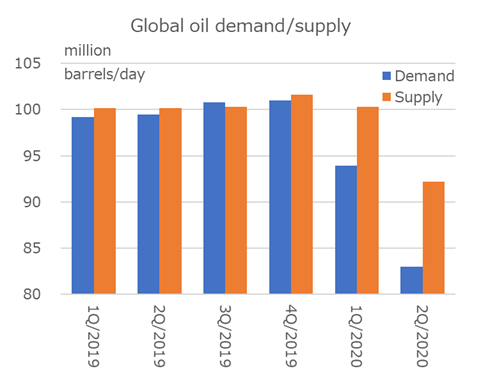

According to the International Energy Agency's (IEA) Oil Market Report, global oil demand in the second quarter of 2020 was down about 17% year-on-year, due to the COVID-19 pandemic. In particular, the decrease in jet fuel for aircraft and gasoline/diesel oil for automobiles was remarkable.

On the other hand, oil production decreased by only about 8 percent even if the coordinated production cut by the OPEC Plus, comprised of OPEC (Organization of the Petroleum Exporting Countries) and major non-OPEC oil-exporting countries, were taken into consideration. As shown in the chart below, there was a significant imbalance between oil demand and supply at 1Q/2Q in 2020.

This loss of oil demand led to a significant oversupply of crude oil, resulting in its negative price.

(Oversupply in 1Q/2Q 2020 are remarkable.)

Demand for oil and tankers

Generally, oil is transported by tankers* from oil-producing countries (exporters) to consuming countries (importers) if there is no pipeline. In 2019, 2 billion tons of crude oil and 1 billion tons of petroleum products such as gasoline, diesel oil, naphtha, jet fuel, etc. were transported by tankers over the ocean. As the impact of COVID-19 had drastically reduced oil demand, oil importers would no longer need to import so much oil, and transportation demand by oil tankers would consequently decline.

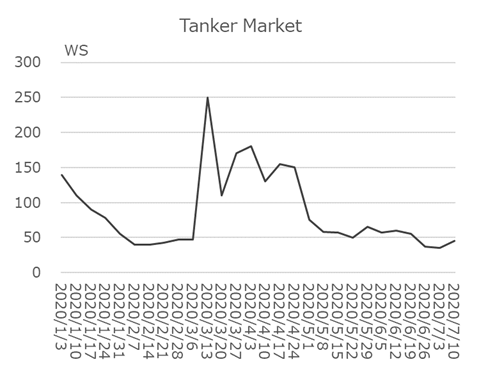

However, contrary to such expectations, demand for tankers did not decline, and the tanker market was boosted despite the fall in oil prices. What happened?

(World Scale, which shows base freight rates for tankers, soared in March and April.)

* "tanker" means ships that transport bulk liquids. It is called a tanker because the space for cargo inside the ship is a tank structure.

Tankers became offshore storage tanks

As with the shortage of storage tanks at Cushing, the sudden loss of global oil demand causes a lack of storage facilities around the world.

However, even if excess crude oil approaches its storage limit, new tanks cannot be built overnight. And then it was time for tanker! Tankers are, of course, designed for transportation of oil, but they could be used for offshore storage facilities because they have multiple tanks to store the oil.

As a result, the demand for tankers, not for transportation but for storage, were increased, and charter hire for tankers was boosted.

What is the reason for storing oil at sea?

Tankers were used as offshore storage tanks not only due to the physical shortage of onshore storage but also tankers can be used for contango* play. If you can fix a futures contract to sell crude oil at a higher price than the lower current price, and if you can make a profit after deducting the cost to store the crude oil during that period, such as charter hire of the tanker as well as miscellaneous expenses, it becomes a solid business proposition.

According to the analysis of one research firm, more than 100 out of approximately 800 VLCCs (Very Large Crude Carrier) in the world were being used for offshore oil tanks.

Tankers not only transport cargo, but in some cases, they can serve as storage facilities for their cargoes. While onshore storage tanks cannot be moved anywhere, tankers can be moved anywhere in the world where they are needed.

* Contango is a situation where the futures price of a commodity is higher than the current price.

Aiming for stable transportation of Oil

Although the spread of COVID-19 remains very serious, global oil demand has been steadily recovering. As oil demand and seaborne oil trades increase, the role of oil tankers returning from oil storage to oil transport. Tankers have once again begun to sail the oceans to deliver our daily energy and support our daily lives without interruption.

The MOL tanker fleets continue to support the world's oil demands and provide high-quality transport services to meet the needs of our customers.

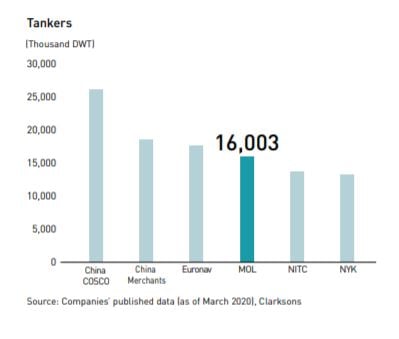

(MOL Tanker Fleet as of March 2020)

(MOL Tanker Fleet as of March 2020)

Writer:Takahiro

Joined the company in 1991. A man in his 50s has experienced in dry bulk shipping, crude oil and petroleum product tanker shipping, and fuel oil procurement for our operated ships before he transferred to market research. Recently he gains excess belly fat probably because he had been involved in oil-related businesses for a long time...

Recommended Articles

2022.07.05

- General Shipping

2021.04.13

- Energy

2025.03.18

- General Shipping

2021.08.07

- Eco Friendly

Latest Articles

2026.02.02

- Eco Friendly

- General Shipping

2026.01.20

- Eco Friendly

- General Shipping