BLOG

Will the Electronic B/L be fully implemented? 5 points to consider

- General Shipping

2021.01.29

The trend towards digitization of Bills of Lading (B/L) has begun to attract attention in the trade and shipping industries.

A huge volume of trade documents is steadily being digitized, but B/Ls, which are documents certifying ownership of cargo and an aspect of security, has been the last hurdle in this move. However, with the evolution of blockchain technology, the movement toward electronic B/Ls is accelerating. In the airline industry, digital Air Waybill's are already the majority and the shipping industry is expected to follow suit. On the other hand, there are still many traders who use fax, e-mail, and other means of communication to communicate with each other, and many people have doubts about the spread of electronic B/Ls. This article describes the current situation surrounding B/Ls and how B/Ls will evolve in the future.

(Right: An example of a B/L surface)

Point.1 Do you know about the "B/L crisis"?

The "B/L crisis" refers to a situation in which in maritime transportation with a short voyage period, such as within Asia, the cargo cannot be picked up because the original B/L has not arrived, even though the cargo has already arrived at the place of discharge.

For example, in case of cargos from Japan, it takes just a few days to arrive in Busan (South Korea), Shanghai (China), or Keelung (Taiwan). In these instances, even though the cargo has arrived in the destination country, it cannot be picked up due to the absence of the B/L. This has become a major problem in the short-distance maritime transportation of cargos between short distance such as Japan and other Asian countries.

Point.2 Three Measures for the B/L crisis

However there are solutions to the "B/L crisis". The following are the three main measures currently used to address this situation;

(i) Surrendered B/L

A B/L is issued by a shipping company (signed by the captain of the ship for goods loaded on board his vessel), but is collected immediately after giving the B/L information to the shipper. Since the B/L is a marketable security in lieu of the cargo, the shipper (i.e. sender) will collect the payment in exchange for the B/L. Therefore, under normal circumstances, the shipper must deliver the B/L to the consignee (i.e. beneficiary) through the bank or other related party. A ‘Surrendered B/L’, on the other hand, means that the shipper sends a B/L to the shipping company which is not the consignee, and the shipping company stamps "Surrendered" or "Accomplished" on the B/L, thereby invalidating the B/L’s function as security. Then the surrender information is promptly communicated to the agent in the importing country by email or other means to ensure smooth pickup at the port of discharge. The reason why "Surrender" is convenient for the shipper is that the consignee can receive the cargo from the shipping company if there is a copy of the B/L regardless of whether it is a FAX or PDF file, which means that they can collect the payment without waiting for the B/L to be distributed.

(ii) Sea Waybill (Waybill)

As mentioned above, a B/L is a marketable security, but the Waybill issued by a shipping company to the shipper, is a mere document that accompanies the shipment and identifies the shipper, the recipient, where the goods originated from, and their destination. Since a Waybill is not a marketable security, it can be delivered by presenting a copy of the Waybill, so cargo can be picked up quickly. A Waybill has no risk of loss and the information on the Waybill can be easily corrected. In the case of a B/L, normally three copies are issued, whereas only one copy of a Waybill is usually issued.

(iii) Using a Letter of Guarantee(L/G)

Again, due to the nature of a B/L as a marketable security, in terms of business customs, using a L/G is widely practiced. In this case, the shipper provides a L/G to the shipping company, which states that the shipper will be responsible for any and all consequences of the delivery of the cargo with a bank acting as joint guarantor, and that the delivery of the cargo can be received even if it is not in exchange for the B/L. As the shipping company is obligated to deliver the cargo described in the B/L when a legitimate and valid B/L holder appears, so the delivery of cargo without a B/L is basically made in the form of a letter of guarantee, subject to the bank's joint guarantees. The bank's joint guarantee is mandatory since it cannot be countered if a legitimate B/L holder appears after the delivery. This is used when cargo transactions are settled by L/C (Letter of Credit).

In the situation where the distribution function, which is the characteristic of a B/L, is hindering the speed of overseas transactions, we have introduced these three countermeasures. Of them, (ii)Waybill can be said to have low trade risks because the handling of B/L is regulated in the International Uniform Rules on Letters of Credit (UCP 600) and the standard operation between export and entry is clarified. For this reason, the United Nations and the Japan Association for the Simplification of Trade Related Procedures (JASTPRO) recommend the use of Waybills. The use of Waybills is expected to increase further in the future to reduce risk and promote digitization.

Point. 3: Why digitize trade documents?

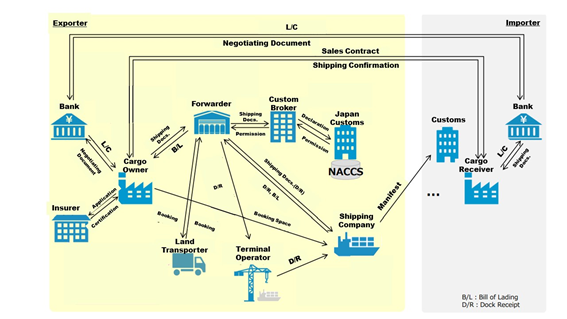

One of the problems in the practice of trade is the inefficiency of documentation and actual delivery of trade documents, resulting in high costs. The exchange of documents in trade transactions is extremely complicated, and in the case of paper-based document transactions, it is said that the same data needs to be retyped more than 10 times before it is transferred from exporters to importers, which requires considerable labor and cost.

An example of a trade procedure in Japan, Resource: Efforts to improve the efficiency of trade procedures in the global supply chain, in August 2019 by the Ministry of Economy, Trade and Industry / excerpted and translated by MOL)

The process can be reduced by digitizing the B/L, but at present, electronic B/Ls are far from widespread. One of the reasons why it is difficult to digitize is the function of the B/L as a security, which is distributed through "Endorsement". Therefore, the holder of the B/L at the time has the right to receive the cargo. However, as mentioned above, in actual trade practice, the B/L will be passed to a number of counterparties before it reaches the actual purchaser of the cargo, so the holder of the B/L at that time has to ‘endorse’ the "Endorsement" on the back of the B/L in order to distribute it. It is said that one of the obstacles to digitization is the need for a secure system to guarantee the endorsement process.

Another reason is that the distribution of electronic B/Ls requires coordination among the countries concerned regarding their laws and operational system of each country related to trade, as well as the system digitization.

It is also pointed out that B/Ls expressed as electronic records are not always widely recognized as B/Ls in every country, and it is unclear whether the Hague-Visby Rules (International Convention for the Unification of Certain Rules of Law Relating to Bills of Lading) will be applied

(Note: Even in Japan, the International Maritime Goods Transportation Act and Commercial law in Article 767 are interpreted as requiring that B/Ls must be in writing, and do not explicitly support electronic B/Ls.)

While there are several issues to be addressed with regard to the digitization of B/Ls, in the field of international trade, both shippers and consignees have been conducting international transactions without major hindrances (Including using the above three measures), and there was no need to introduce electronic B/Ls in a hurry. This is the main reason why the study of the digitalization of B/Ls has been delayed.

Point. 4 Efforts to digitize trade procedures

The move to electronic B/L has been around for several decades, and there are several companies providing platforms. However, all of them are still localized and a unified system that covers the entire world has yet to be developed. In order for electronic B/Ls to be distributed properly, it is necessary to have related parties, such as shippers, banks, shipping companies, and consignees, participate in the same platform. However, there remain issues such as confidentiality, and many parties are not prepared to participate.

On the other hand, in the field of bulk transportation, such as natural resources, the use of electronic B/Ls is expanding. In the case of natural resource transportation, the transportation cost per B/L is high, and the number of parties involved in the transportation is limited to a small number. As a result, the advantages of electronic B/Ls have begun to be recognized, such as the prevention of fraudulent transactions such as forgery of documents, and improvements in the efficiency of fund collection by speeding up distribution.

The use of electronic B/Ls is starting to spread as, for example, major resource companies using electronic B/Ls are now willing to use them for container transportation as well.

Point. 5 Container Shipping Company to Switch to Electronic B/L

Recently, container shipping companies have been expanding their initiatives. Ocean Network Express (ONE) which was established by MOL, NYK, and K-Lines have announced that they will promote the use of electronic B/Ls in cooperation with IT companies, and it is expected that this will facilitate B/L transactions. Many IT companies use blockchain technology to simplify and speed up procedures by ensuring reliability and digitization. This trend in container ships, which handle a large number of cargoes and are associated with a large number of shippers and consignees, is attracting a great deal of attention as a way to promote IT in the shipping industry.

B/Ls, which have marketable securities functions and are tradable, have been traded on a paper basis (hand delivered or mailed), but the expansion of electronic B/Ls is expected to change the container supply chain by laying the ground work for greater operational efficiency and cost reductions.

IBM and others have already developed individual trade information management systems that use distributed ledgers, and Southeast Asian countries are promoting the digitization of trade administration under the leadership of their government. In Japan, we have been conducting studies in the form of consortiums since 2017, and we plan to develop Japan's first platform for processing trade documents in order to fully digitize trade documents across industries.

Finally, the gradual global shift to digitization is a welcome development for the logistics industry. Driven by the current demand for social distancing due to the COVID-19, we may never again have to go directly to a B/L counter to pick up cargo in the near future.

B/Ls are issued in a variety of units, but mainly one B/L is issued per transaction. Due to the nature of cargo transactions, particularly in the case of containers and automobile transportation, a large number of documents need to be issued. Shipping companies, including MOL, are gradually making efforts to digitize these documents. The MOL Car carrier service (MOL Auto Carrier Express: MOL ACE), whose service is posted on this website, are also taking various measures to deliver customers' cargoes safely and securely.

Writer:Akina

Joined MOL in 2014 after working for a credit card company. After being in charge of car carriers administration, operating bulk carriers, now I’ve been involved in the operation of this website, in the marketing division. I'm also in charge of website news letter. Easy to subscribe, please click below!

Recommended Articles

2022.07.05

- General Shipping

2021.04.13

- Energy

2025.03.18

- General Shipping

2021.08.07

- Eco Friendly

Latest Articles

2026.02.02

- Eco Friendly

- General Shipping

2026.01.20

- Eco Friendly

- General Shipping

2025.12.09

- Eco Friendly

- General Shipping