BLOG

Ammonia in the Spotlight: Five Things to Know

- Eco Friendly

2021.11.16

Ammonia is drawing attention as we work toward carbon neutrality by 2050. Why is ammonia, which has been used mainly as an agricultural fertilizer and a basic material for chemical products, now being proposed as a fuel? In this article we will focus on ammonia, which has great potential as a new energy source in the decarbonization era, and explore its trends.

If you have any questions about this blog or would like to know more, please contact us through Contact form.

Why is ammonia getting so much attention now?

Ammonia, as a “hydrogen carrier”, is now attracting increasing attention. The term "Hydrogen carrier" refers to a means of transporting and storing hydrogen energy. Hydrogen is an earth-friendly energy source that does not emit CO₂ when it is combusted. However, various infrastructure developments and demonstration experiments are currently being conducted because hydrogen is a substance that is difficult to handle for long distance transportation and storage. (Press release: https://www.mol.co.jp/en/pr/2021/21069.html

On the other hand, ammonia is already widely used around the world for fertilizers and other purposes, and it is possible to develop infrastructure using existing manufacturing, transportation, and storage technologies. Ammonia, with the molecular formula “NH3”, is a compound composed of hydrogen (H) and nitrogen (N). It is a colorless and transparent gas at normal temperature and pressure, and is easily soluble in water and ethanol. It is designated as a "Deleterious Substance" by law because of its strong pungent odor, corrosiveness, and exothermicity. It is also easy to transport and store because it liquefies at room temperature and around 10 atmospheres of pressure.

(Related website: https://www.nexanteca.com/news-and-media/new-analysis-market-analytics-ammonia-and-urea-2020-0)

About 80% to 90% of ammonia is used as fertilizer. Ammonia is essential for plant growth and is chemically produced worldwide as a raw material of fertilizer for agricultural crops. Most of the remaining 10% to 20% produced are for industrial use, such as basic materials for chemical products. Hydrogen is required to synthesize ammonia, but this hydrogen is mainly derived from fossil fuels such as natural gas. Recently, however, it has become common to use more ecofriendly ammonia, so-called Blue ammonia and Green ammonia and is expected to find new applications as a fuel. The technological developments should be advanced toward practical use.

- Blue ammonia ; carbon dioxide produced by the conventional fossil fuel-derived process to be collected through CCS (carbon dioxide capture and storage) or CO2-EOR (crude oil enhanced recovery method using CO2 injection)

- Green ammonia ; made from hydrogen produced by electrolysis of water, using electricity derived from renewable energy sources such as solar power.

%20NexantECA%20(2020).png?width=594&name=Global%20Ammonia%20Demand%20(Source)%20NexantECA%20(2020).png) Global Ammonia Demand (Source) NexantECA (2020)

Global Ammonia Demand (Source) NexantECA (2020)

The current mainstream ammonia production method is the “Haber-Bosch process”, which was established by German chemists Fritz Haber and Carl Bosch about a century ago. This method involves the reaction of nitrogen in the air with hydrogen obtained from hydrocarbons at high temperatures and pressure (400 °C to 500 °C, 10 to 30 MPa) using an iron oxide catalyst. Research on new production methods is also underway to solve such problems as the large amount of energy that is required in the production process, the emission of CO2, and that the hydrogen is derived from fossil fuels.

Ammonia Supply and Demand Worldwide

Ammonia production worldwide was about 200 million tons in 2019. China accounts for more than 20% of global production, while Russia, the United States, India, Indonesia and Saudi Arabia account for about half of global production. The raw material is natural gas produced in the area where the ammonia plants are located (including associated gas from oil fields) or nitrogen derived from coal.

90% of the ammonia produced is consumed domestically. The top producing countries are all large agricultural countries with large populations, and most of the ammonia is used as a raw material for agricultural chemical fertilizers.

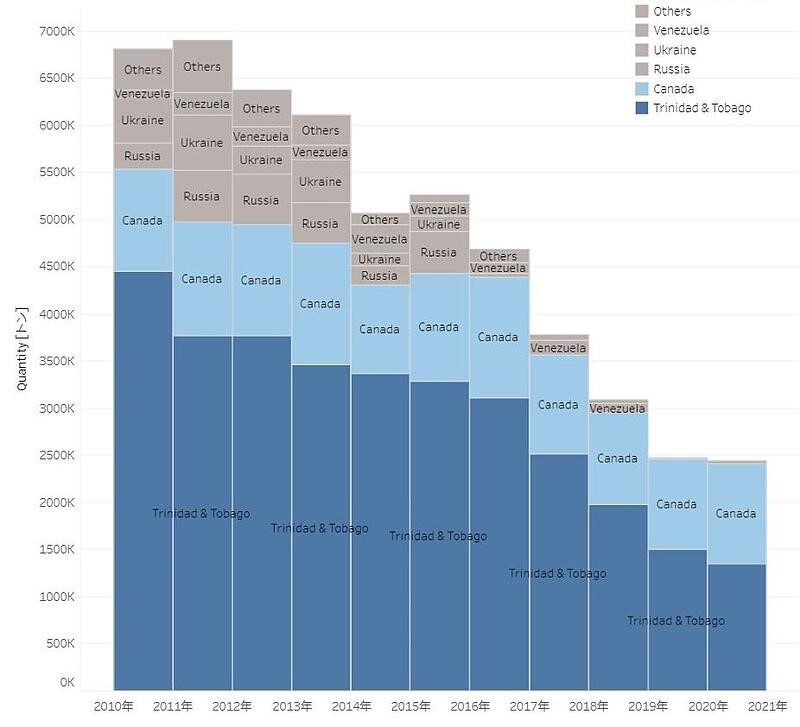

About 20 million tons, or about 10% of global production, is imported or exported (2018). Trinidad, Tobago and Russia each account for more than 20% of the export volume, followed by Saudi Arabia and Indonesia at less than 10% each. These four countries account for 60% of global exports.

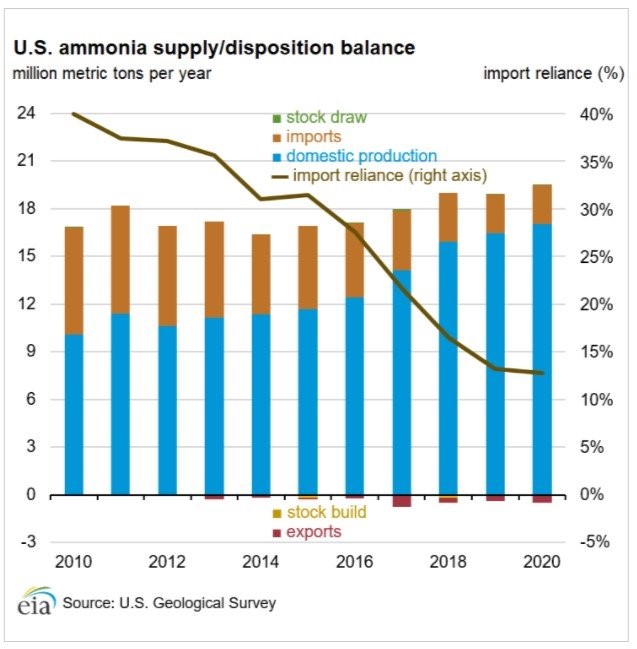

The United States is the top importer. It is a major agricultural country and produces a large amount of ammonia itself (the third largest), but it also imports a large amount of ammonia. The Republic of Trinidad and Tobago is the largest U.S. trade partner in ammonia, followed by Canada, and these two countries account for the majority of U.S. imports. According to EIA reports, natural gas-based plants are the main source of ammonia production in the U.S., accounting for 92% of the U.S. ammonia production. Domestic production is increasing due to capacity expansions. This is a result of an increase in natural gas production and a resulting decline in prices. Ammonia is produced in 32 plants in 17 states. Pipelines, railways, barges, and trucks are used for domestic shipments. The total import volume has been decreasing since around 2010. The U.S. dependence on imported ammonia declined from 40% in 2010 to 13% in 2020 as domestic production growth outpaced demand growth.

India is the second largest importer. India's main trade partners are Saudi Arabia, Qatar, the Ukraine, and Egypt. In Europe, Russia, Algeria, and the Ukraine are the main trade partners, showing a tendency to import from countries close to each other.

Trends of trade partners in the United States 2010 -2021

Trends of trade partners in the United States 2010 -2021

Reference Data: IHS Markit Created by MOL

Trends of Ammonia supply allocation in the United States 2010 -2020

Source: EIA

The ammonia market is expected to continue to grow, with an average growth rate of 2.03%, between 2020 and 2026, according to Mordor Intelligence. In particular, the United States and the Middle East, where ammonia is made from natural gas and is highly competitive in terms of manufacturing costs, have high growth rates. However, most of the ammonia produced in the United States is consumed domestically and is not distributed. In addition, the market in India is expected to grow as ammonia use is expected to increase in tandem with population growth and urbanization.

Why is ammonia attracting attention as a fuel?

Ammonia is expected to be a clean alternative to fossil fuels. Japan has positioned ammonia as a next-generation fuel, along with hydrogen in its "Green Growth Strategy Through Achieving Carbon Neutrality in 2050", which was formulated in December 2020. The growth of ammonia as fuel industry is one of the most important strategies for decarbonization.

Ammonia fuel does not emit CO2 during combustion, so it is expected to be used in a wide range of applications, from power generation to industrial use in factories and transportation. Ammonia fuel is most expected to play a role as a "fuel for thermal power generation" in order to achieve carbon neutrality. There is an effort to drastically reduce CO2 emissions by switching the fuel of coal-fired power generation to ammonia while using existing coal-fired power generation facilities. If major electric power companies switch coal-fired power plant to 100% ammonia-fired power generation by 2050, 200 million tons of CO2 emissions could be reduced. It is estimated that this would halve the amount of CO2 emitted by the electric power sector in Japan.

The world's first large-scale demonstration of thermal power generation using coal and ammonia, “co-firing” began in June 2021 at JERA's Hekinan Thermal Power Station in Aichi Prefecture. Technologies and equipment are being developed aiming for full-scale operation of 20% co-firing by 2024. In addition, the NEDO "Research, Development and Demonstration of Technologies for Ammonia Co-Firing Thermal Power Generation" has been adopted for power development and other projects, and we are paying attention to future trends.

Also, in the forecasts made by various organizations and research institutions, there was full consensus that ammonia is expected to replace heavy oil as a marine fuel by 2050, along with carbon-recycled methane and hydrogen.

Please see this blog for the transition of marine fuel: History and Transition of Marine Fuel

Transportation of Ammonia

image of the Large-size Ammonia Carrier Powered by Ammonia Fuel

One of the key areas of interest in ammonia usage in the energy field is as a “transport medium for hydrogen”. Hydrogen is more expensive to transport and store compared to gasoline. Ammonia, which contains a large amount of hydrogen in its components, is easily converted into a liquid at room temperature and at around 10 atmospheres of pressure. Therefore, the cost of importing and exporting hydrogen can be greatly reduced by transporting liquefied ammonia from production sites and decomposing and extracting it at consumption sites. The technology and international transportation infrastructure have already been established, which is another reason ammonia is attracting attention.

As mentioned earlier, the import and export of ammonia is already taking place worldwide, mainly for fertilizer applications, and transportation methods have been established. It is transported by sea in various regions of the world using ammonia vessels or LPG vessels (liquefied petroleum gas) that are capable of liquefaction and transportation by pressurizing or cooling gas. At present, however, there are few ocean-going vessels used exclusively for ammonia. Ammonia is transported by multipurpose vessels (multipurpose gas vessels such as LPG vessels) that can carry ammonia because ammonia is liquefied under almost the same conditions as LPG which is commonly in circulation.

According to a report by the Swedish shipboard equipment manufacturer, ALFA Laval, the amount of ammonia transported by sea in 2019 was 17.5 million tons worldwide, and was transported by 71 vessels in the 2,500 to 40,000 ton class.

Toward the Establishment of an Ammonia Supply Chain and the Commercialization of Ammonia Transportation

Major Japanese trading companies and others are already actively working to establish ammonia supply chains and commercialize its transport. They have entered into agreements with producing centers and production companies, and are working toward the production and procurement of green and blue ammonia.

Demand for ammonia transport is expected to grow rapidly. In May 2021, Mitsui O.S.K. Lines. signed a time charter contract with Trammo, a major ammonia trader in the United States, and re-entered the ammonia transport business. On 11August, we signed a memorandum of understanding with Origin Energy of Australia to conduct joint research on the establishment of a green ammonia supply chain.

At the same time, development of technologies for ships fueled by ammonia is making progress. The LPG and ammonia carriers (dual fuel of LPG and heavy oil) currently under construction by Mitsui O.S.K. Lines. are designed to be converted into an ammonia-fueled ship in the future. MOL will continue to actively work toward the practical application of ammonia fuel and the achievement of carbon neutrality in response to prevailing trends and environmental issues.

Writer:Akina

Joined MOL in 2014 after working for a credit card company. After being in charge of car carriers administration, operating bulk carriers, now I’ve been involved in the operation of this website, in the marketing division. I'm also in charge of website news letter. Easy to subscribe, please click below!

Recommended Articles

2022.07.05

- General Shipping

2021.04.13

- Energy

2025.03.18

- General Shipping

2021.08.07

- Eco Friendly

Latest Articles

2026.01.20

- Eco Friendly

- General Shipping

2025.12.09

- Eco Friendly

- General Shipping

2025.12.03

- General Shipping