BLOG

Analyzing Africa from a Shipping Industry Perspective (2)

- Market Analysis

2021.02.10

In the first of a series of blogs analyzing Africa from a shipping industry perspective, we looked at Africa's future development and business potential from the aspect of its history and economic structure. Resource exports are a valuable source of income for African countries, however resource prices are highly volatile and a source of instability in economic growth. This article will focus on agriculture, which is arguably the key to Africa's future growth, and examine the relationship between agriculture and logistics, including maritime transport.

The first blog in this series can be found here: Analyzing Africa from a Shipping Industry Perspective (1)

Why Agriculture Is Key to Africa's Growth

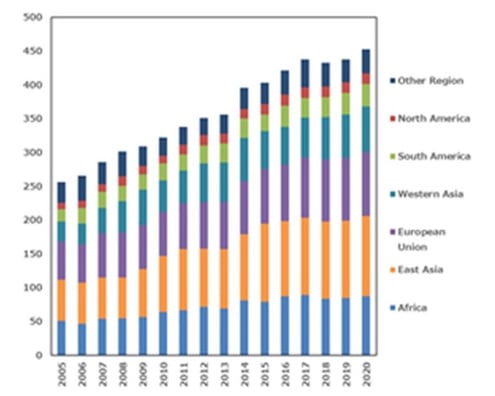

Agriculture is a major industry in Africa, accounting for about 20% of GDP and 60% of employment. Most of the farmers are smallholder farmers who lack sufficient agricultural knowledge and skills and have suffered from soil fertility loss due to excessive farming and abnormal weather conditions. Without taking any concrete measures to improve productivity, they have been dependent on imports, and food imports have been on the rise as the population increases (see graph below). Africa's grain imports account for approximately 20% of the world's grain imports, almost the same level as that of East Asia (Including the Southeast Asian countries).

It is estimated that Africa's population will account for a quarter of the world's population by 2050, and improving agricultural productivity is essential for Africa's future growth in order to provide for its ever-increasing population. With the COVID-19 disaster reaffirming the importance of food security, increasing domestic self-sufficiency and expanding agricultural profitability will be necessary for sustainable growth in Africa.

Grain imports by region(million tons). extracted by HS code (1001 ~ 1008).

Mainly rice, corn, and wheat. Soybeans are not included.

East Asia includes Southeast Asian countries.

How are agricultural products imported?

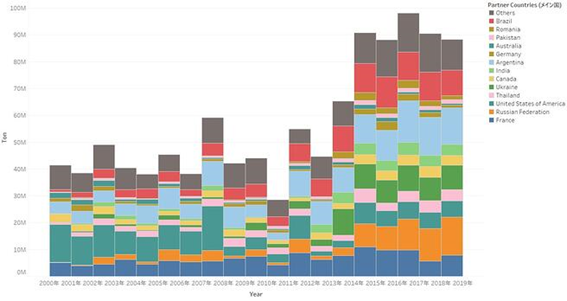

Africa accounts for 20% of the world's grain imports. What, and from which countries do they import? The following graph shows the destination of grain imports in Africa. The main grains imported (major importer) are wheat (France, Russia, and the United States), rice (India, Thailand), corn (United States and Argentina), soybeans (United States and Argentina), and sugar (Brazil).

(Africa’s grain (Wheat, corn, rice, soybeans, sugar) import destinations (based on HaoStat, Created by MOL)

These grains are mainly transported by bulk carriers and container ships. While containers often carry bagged grain, bulkers carry a variety of other cargoes in bulk, such as coal, cement, and various minerals. Therefore, when transporting grain, which is foodstuff, we need to strictly check what the previous cargo was, carefully clean the hold (a hold in which cargo is loaded), and inspect the hold to see if it is ready to load grain. The cleaning includes not only sweeping and washing, but also rust removal, painting, and drying inside holds to ensure safe contamination-free transportation of grain.

A scene showing loading and discharging of rice.

Source: Port Authority of Abidian HP)

The graph above also shows that grain imports have been increasing since around 2015. Drought, urbanization and other factors may be behind this, but it is also due to the increased purchasing power of African countries as a result of the resource boom. If grain prices rise, price increases could lead to higher inflation. Higher prices will also affect wage levels, making the labor force less competitive. Africa’s growth depends on fostering a highly productive agriculture which benefits a large number of agricultural workers.

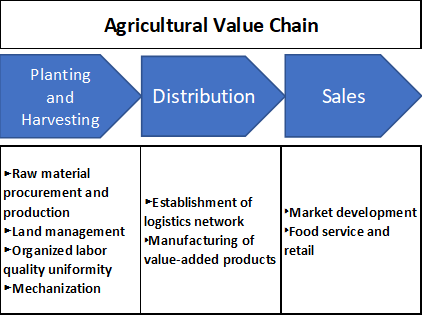

In 2013, the World Bank published a report entitled "Growing Africa" which identified the potential for African agricultural businesses to generate $1 trillion in food markets by 2030. TICAD 7 (held in August 2019) reaffirmed the need to promote higher quality and value-added products, develop value chains, and thereby support the structural transformation of agriculture, in order to accelerate Africa’s economic growth and diversification, with agriculture as the key to growth.

Start-up companies in the Agricultural Value Chain

Agriculture has many phases, from production to processing and sales, and a wide range of markets. However, it will not expand unless the entire value chain is connected. There seem to be many issues to be solved, but local farmers are increasingly accessing digital services, and digitalization is said to be the key to growth. In the next section, we will divide phases of the agriculture into three segments: planting and harvesting, distribution, and sales, and examine the current status and challenges of each phase, as well as and the movements of start-up companies working on them.

Why productivity is low?

Most farmers in Africa live on small plots of land, self-sufficient in what they and their families eat, and do not need a lot of cash. They can only grow to the extent that they can manage and manually plow the fields they cultivate in accordance with the timing of rainfall. Due to a lack of human resources with specialized knowledge, the introduction of fertilizers and machinery has been delayed and productivity has not improved.

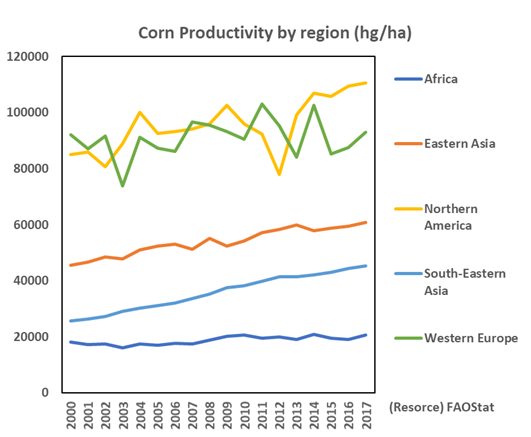

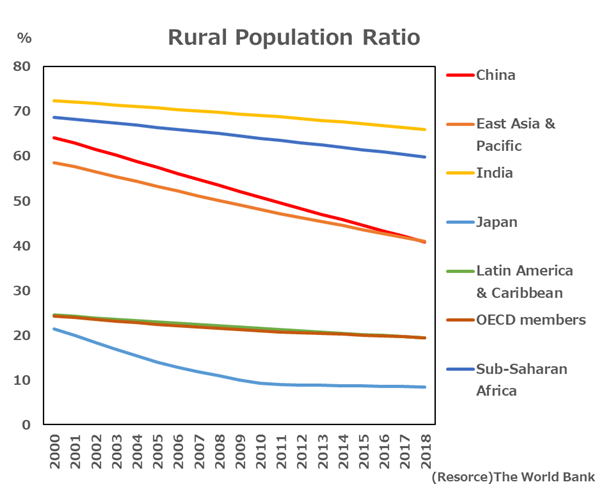

Harvesting has also been hampered by a lack of uniformity in crop size and quality, storage processes, and the use of tractors and other machinery which has also prevented any increase in productivity. For example, the productivity of maize, one of the staple foods in East Africa, is much lower than that of the rural population. (See graph below)

(Africa's rural share is second only to India)

Start-up companies are working to improve this situation. In Nigeria and Cote d'Ivoire, companies have emerged that use drones to spread fertilizer and pesticides, and in Tunisia a company that uses AI to manage irrigation facilities has been launched. In addition to these so-called agritech start-up companies, WeFarm in Kenya is a service which allows farmers around the world to ask questions, get advice, and consult with experts via cell phone SMS on their mobile phones. WeFarm is also designed to introduce companies that handle agricultural materials such as seeds and fertilizers, as well as farming equipment, and is expected to help farmers who have limited access to information accumulate knowledge and improve productivity.

Improvement of transportation infrastructure

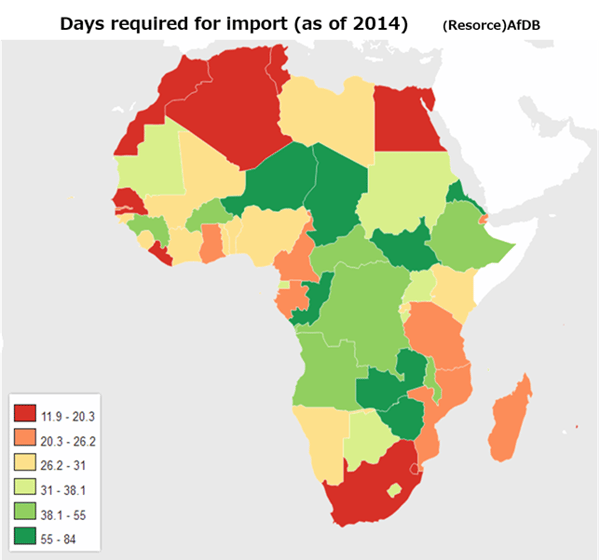

Transportation infrastructure, which serves as a distribution channel, is essential for access to agricultural land and sales markets. Many railroads and highways were constructed and maintained during the former colonial period, but the condition of much of this infrastructure has deteriorated due to a lack of maintenance by countries after independence. As a result, it has been found that it takes nearly 2 months for imported goods to reach their destination, particularly in inland areas (See diagram below).

(The number of days required for each country to receive imports. It takes longer to reach inland countries.)

In general, port facilities have not been able to cope with the increasing volume of international trade, and some of them have exceeded or are approaching the limit of their design capacity, a factor which may hinder Africa's growth. In order to solve these problems, the Japan International Cooperation Agency (JICA) and other organizations are providing support for the development of cross-border transportation infrastructure (CBTI), which is the infrastructure necessary for cross-border transportation across multiple countries. CBTI includes both hardware and software components and has been introduced in various parts of Asia as well as Africa.

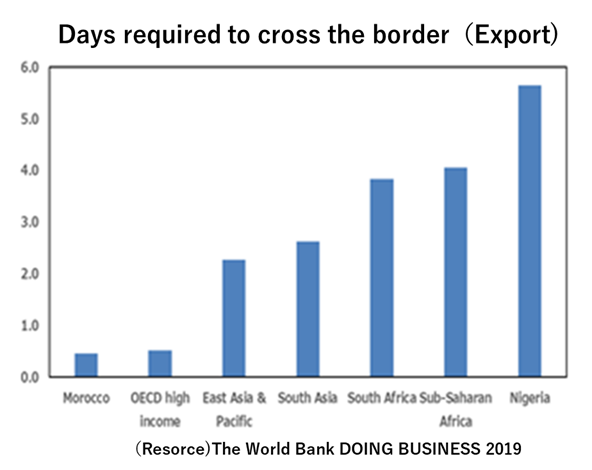

One Stop Border Post (OSBP) is currently drawing attention. OSBP either integrates the border facilities of two countries into one, or creates a customs administration system that establishes a place for procedures in only one country. JICA and other organizations support the introduction of OSBP. Examples of OSBP in use include between Tanzania and Rwanda, where the time required for customs clearance of cargo has been reduced from 9 hours to 2 hours (according to JICA estimates, a reduction in transportation costs of approximately $1.4 million per year). Between Zambia and Zimbabwe, where the time required to cross the border, which was once between 4 to 5 days, has been reduced to between a few hours to 3 days. Port development is also being carried out as part of CBTI support, and there are many examples where the expertise of Japanese companies is in demand, such as the expansion of the container terminal in Mombasa, Kenya in 2016, and most recently Toyota Tsusho's participation in Angola's port development.

There are also start-up companies that aim to digitize the entire transportation process. In Côte d'Ivoire, some companies have started a service that unifies the management of transportation routes and carrier information and matches them with cargo. Also, in Morocco and South Africa, a service has emerged that uses apps to match carriers and shippers and digitally manages transportation procedures and tracking, including calculation of transportation costs.

(The number of days required to cross the border mainly through customs clearance procedures. Africa is by far the longest.)

Sales

The final task is the development of markets for the buying and selling of agricultural products. The development of a consumer market is key here. In recent years, urbanization has been steadily progressing in Africa, but markets are considered to be difficult to form because most of the population lives in rural areas. In order for these countries and areas with small economies to develop their economies and create consumer markets, it is necessary to create regionally integrated economies of a certain size. For this reason, there are many economic communities in Africa. The historical backgrounds of many of these countries dating back to the colonial period has resulted in the ratio of trade with countries outside the region, including Europe, being higher than within the region. However, with the advent of the African Continent Free Trade Area (AfCFTA) intra-regional partnerships are expected to expand under a Free Trade Agreement (FTA) that includes the elimination of intra-regional tariffs on goods and the promotion of trade in services and investment in Africa. If all 55 countries and regions in the continent participate, the AfCFTA will be the world's largest community, with a population over 1.2 billion people(2018) and a total nominal GDP value of $2.2 trillion(2017), and can be expected to play an important role in market formation.

Intra-Regional export ratio in Europe, Asia and Africa (Resource: JETRO)

To support people's lives in growing markets of Africa

We hope you have been to grasp the potential for economic growth and the creation of new value in Africa through agricultural development. However, the reality is that many countries in Africa are still facing a number of issues such as severe food shortages and social problems such as poverty, and the COVID-19 disaster has only exacerbated these difficulties. Despite this, there still seems to be plenty of scope for resolving issues through trade and the use of digital technology.

For the future development of agriculture in Africa, MOL, in addition to our contributions in the fields of stable energy supply and logistics, are also launching new initiatives. This includes providing used Japanese agricultural machinery to help improve productivity. We believe these efforts will help Africa contribute towards the further development of the global economy and address some of the social issues facing African countries.

Our power generation ship business in Africa helps provide a stable power supply.

To find out more click here.

Recommended Articles

2022.07.05

- General Shipping

2021.04.13

- Energy

2025.03.18

- General Shipping

2021.08.07

- Eco Friendly

Latest Articles

2026.01.20

- Eco Friendly

- General Shipping

2025.12.09

- Eco Friendly

- General Shipping

2025.12.03

- General Shipping