BLOG

Beyond ESG Series: Universal Ownership and Corporate Behavior (Part 1) - Responding to Climate Change, Natural Capital, and Biodiversity

- General Shipping

2024.01.23

ESG (Environment, Social, Governance) has long been a prominent term on the center stage in the world, representing the most crucial issues in finance and the economy, but today it is regarded as an essential issue for companies to achieve stable growth over the medium to long term. While it is true that anti-ESG and other such activities have emerged in recent years, especially in consideration of political implications, the importance of ESG itself remains unchanged from the viewpoint of non-financial information. Furthermore, in view of the current state of the World, such as regarding climate change and the deteriorating situation of natural capital, it is undeniable that the time has come when ESG thinking alone is not sufficient.

Therefore, we would like to consider the corporate behavior required from the perspective of ‘Beyond ESG’. In this first part of the ‘Beyond ESG Series’, we review the history of ESG and present an overview of ESG, focusing on the social context in which the concept originated.

Introduction

"Universal owner" means an investor whose assets under management are large and whose portfolio is widely diversified in the global capital markets. And because of the huge amount of assets under management, the investments can be seen as investments in virtually the entire market rather than specific companies. Therefore, rather than focusing on the good or bad performance of individual investee companies, we emphasize “universal ownership”, in which we actively take actions to avoid situations in which the environmental impact of some companies has a negative impact on society. From this perspective, ESG issues, especially events related to climate change, natural capital, and biodiversity, whose impact will manifest from a long-term perspective, will be of fundamental importance to the "Universal Owner." This begs the question “What kind of action is required on the corporate side today when the international situation is becoming such that the idea of ‘universal ownership’ is drawing attention?”

In order to examine this issue, we would first like to look back from a historical perspective on the relationship between changes in thinking and companies with respect to socially responsible investment (Socially Responsible Investment (SRI)), which in a sense is the predecessor of ESG.

Changes in the concept of Socially Responsible Investment (SRI)

RI is the practice of selecting investment targets and making investments in consideration of social responsibility, which is concerned with social and ethical aspects. The history of SRI can be traced back to the Christian code of ethics in the 17th and 18th centuries, and in the 1900s it was embodied in the prototype of negative screening, a method of investment by churches and charitable organizations to exclude investments in alcohol, tobacco, and gambling-related companies.

This was the original form of the investment practice known as negative screening. John Wesley, founder of the Methodist Church, a Protestant sect derived from Christianity, in his sermon collection of religious precepts, "The Use of Money (1872)", admonished that the basic premise of acquiring money is "not to earn it to the detriment of your neighbor's spirit and body”. This means that Christian churches are not to give money (invest) in businesses (tobacco, gambling, alcohol) that violate the code of ethics when it comes to asset management.

This was the original form of the investment practice known as negative screening. John Wesley, founder of the Methodist Church, a Protestant sect derived from Christianity, in his sermon collection of religious precepts, "The Use of Money (1872)", admonished that the basic premise of acquiring money is "not to earn it to the detriment of your neighbor's spirit and body”. This means that Christian churches are not to give money (invest) in businesses (tobacco, gambling, alcohol) that violate the code of ethics when it comes to asset management.

Image: John Wesley, Methodist traveling preacher, organizer of the Methodist Conference, and founder of the Methodist Church

Around the 1950s, public interest in social and environmental issues grew on the back of the development of mass media, particularly the spread of television, and the attention turned to corporate behavior that has a significant impact on these issues. With the rise of the global civil movement against war and human rights issues, it became a matter of great interest to investors.

Examples of well-known shareholder proposals include one that called for a company that manufactured napalm bullets used in the Vietnam War to cease production and another that called for certain companies to withdraw from apartheid South Africa. Apartheid*1 became the target of international criticism, and as the United Nations and Western countries took the lead in imposing economic sanctions on South Africa, the number of SRI funds (organizations that manage funds) that excluded South African-related companies rapidly increased. Divestment, in which churches and universities sold their shares in companies operating in South Africa, also became more active. The withdrawal of British and U.S. financial institutions, which had been the largest providers of funds, led to South Africa's declaration of default in 1985, and SRI's presence in the country grew.

US military firing napalm, now banned under international law, during the Vietnam War. US Navy photograph (left). Chair labeled ‘NON-WHITE ONLY’ (right)

*1) Apartheid was also practiced in Rhodesia before the country changed its name to Zimbabwe in 1980, and was subject to United Nations economic sanctions.

As in the above cases, some companies are negatively evaluated and negatively screened. On the other hand, companies that are implementing social and environmental initiatives are positively evaluated. In the 1990s, positive screening became one of the investment methods. As the scope of SRI has expanded to include social and environmental issues, it has become easier for investors to invest in companies that meet their values and interests. In the 2000s, with the spread of positive screening, SRI funds for social and environmental issues expanded.

ESG and Information Disclosure

The UNCED*2, also known as the Earth Summit, held in Rio de Janeiro, Brazil, in 1992, serves as the origin of climate change policies, since it gave rise to the UNFCCC*3 which is parent treaty to the Kyoto Protocol and today's Paris Agreement. At the same time, the signing of the Convention on Biological Diversity (CBD)*4 started at the Summit. This conference has made climate change an issue of international concern, including the general public, and in response to this trend, it has become one of the most important issues for companies and investors from the perspective of CSR*5 and SRI.As social and environmental issues become a major concern for investors, companies are moving into an era where their behavior needs to change.

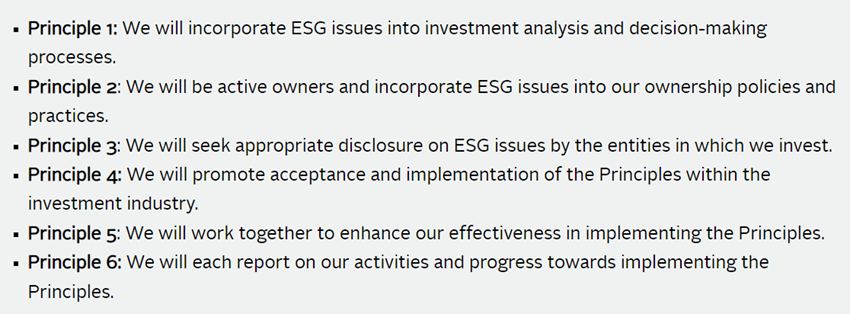

In 1994, John Elkington announced the concept of the Triple Bottom Line, which refers to the evaluation of corporate activities not only from a financial performance standpoint, but also from the three aspects of the environment, society, and economy. The concept was included in the international guidelines for promoting CSR (GRI guidelines*6), which had a significant impact on corporate behavior. The investor side has also evaluated such companies, and the SRI content has shifted its focus to one that considers global environmental issues. The series of financial scandals involving major corporations in the United States in the early 2000s became a significant concern for investors as an issue of internal control within the companies themselves. In 2006, Kofi Annan, then Secretary General of the United Nations, clarified the Fiduciary Duty for institutional investors, stating "Institutional investors have an obligation to take a long-term perspective and pursue maximum profit for their beneficiaries", and taking into consideration it, released the UNPRI, which states in principle that investors should consider not only financial information but also ESG issues in the decision-making process.

In 2006, Kofi Annan, then Secretary General of the United Nations, clarified the Fiduciary Duty for institutional investors, stating "Institutional investors have an obligation to take a long-term perspective and pursue maximum profit for their beneficiaries", and taking into consideration it, released the UNPRI, which states in principle that investors should consider not only financial information but also ESG issues in the decision-making process.

Image: Kofi Annan

*2) United Nations Conference on Environment and Development

*3) United Nations Framework Convention on Climate Change (UN Framework Convention on Climate Change)

*4) Convention on Biological Diversity: The only international convention that considers biodiversity on a global scale and aims to conserve it, not just individual wildlife species or local ecosystems.

*5) Corporate social responsibility refers to the concept of not only seeking profits but also taking responsibility as a company to contribute to society through environmental activities, volunteer work, donations, and other activities.

*6) Global Reporting Initiative

![]()

SRI originated as a Christian rule and had a strong ethical dimension. It was centered on the idea of negative screening of specific companies that did not fit those rules or ideas, or positive screening of excellent companies.

ESG, on the other hand, focuses on non-financial information that will have a significant impact on corporate value in the future, although its impact does not directly affect financial matters, such as environmental and social issues and corporate governance. Therefore, while SRI is primarily directed at a select group of companies, ESG covers companies in general. Moreover, at the root of ESG investments is the securing of profits based on economic rationality, which considers long-term social returns in addition to economic returns.

The financial crisis of 2009 was an opportunity to deeply remind us of the importance of the long-term perspective and the systemic risk that the failure of one financial institution could spread to other financial institutions and other markets, causing the entire financial system to fall into crisis. In Japan, the Japanese version of Stewardship (2014), sets forth principles that are considered useful for being a "responsible institutional investor," and the Corporate Governance Code (2015), which sets forth principles and guidelines to be referred to as guidelines in corporate governance conducted by listed companies. The relationship between social and environmental issues of individual companies is difficult to see from the investor side, and the impact on corporate value is not easy to assess. Therefore, more specific information disclosure is required. In particular, the importance of information disclosure on climate change issues will be linked to the TCFD*7.

The relationship between social and environmental issues of individual companies is difficult to see from the investor side, and the impact on corporate value is not easy to assess. Therefore, more specific information disclosure is required. In particular, the importance of information disclosure on climate change issues will be linked to the TCFD*7.

Image: Mark Carney, creator of TCFD

Under the Kyoto Protocol, the Kyoto Mechanism was introduced, and in the first commitment period (2008 to 2012), the introduction of carbon pricing*8 in advanced countries, such as the obligation to reduce emissions and the implementation of emission trading, made it possible to evaluate companies numerically. It has enabled companies and investors alike to make objective assessments from an ESG perspective and has since become one of the most important pieces of non-financial information disclosed in TCFDs. More recently, regarding natural capital and biodiversity, which are deeply related to climate change issues and are also feared to be worsening, companies are required to respond to the TNFD (Taskforce on Nature-related Financial Disclosures), including disclosing specific information on their mutual impacts.

*6) Task Force on Climate-related Financial Disclosures - an initiative to disclose financial information of each company along with the status and examples of responses to environmental risks.

*7) Policy methods such as "carbon tax" and "emissions trading" were introduced to put a price on CO2 emitted by companies and thereby change the behavior of emitters.

Please refer to the disclosure information based on MOL's climate change countermeasures /TCFD. https://www.mol.co.jp/en/sustainability/environment/tcfd/

In the 1st part of this blog, we discussed the historical background leading to today's ESG and the changes in thinking and behavior from the perspectives of both companies and investors.

In the 2nd part, we will look at ESG from the perspective of whether companies are required to move beyond ESG thinking in response to the current crisis in the foundations of the economy and society.

.png)

Beyond ESG Series: Universal Ownership and Corporate Behavior (Part 2) - Responding to Climate Change, Natural Capital, and Biodiversity

Writer:Ken Tammoto

MPhil of Development Studies from University of Cambridge, I am a former Program Officer at the United Nations Environment Programme (UNEP) headquarters in Nairobi, Kenya. After returning to Japan, I accumulated experience in various sectors, including government, banking, and securities-related think tanks. In 2022, I joined MOL as the Principal Strategist in the Energy Business Strategy Division. With over 30 years of involvement in climate change policy, my professional journey has been dedicated to addressing environmental challenges. While I have a wide range of hobbies, living without music is simply unimaginable for me.

Recommended Articles

2022.07.05

- General Shipping

2021.04.13

- Energy

2025.03.18

- General Shipping

2021.08.07

- Eco Friendly

Latest Articles

2026.02.02

- Eco Friendly

- General Shipping

2026.01.20

- Eco Friendly

- General Shipping

- BLOG

- Beyond ESG Series: Universal Ownership and Corporate Behavior (Part 1) - Responding to Climate Change, Natural Capital, and Biodiversity