BLOG

Beyond ESG Series: Universal Ownership and Corporate Behavior (Part 2) - Responding to Climate Change, Natural Capital, and Biodiversity

- General Shipping

2024.02.20

From the standpoint of long-term corporate growth, ESG remains a crucial concept for both investors and companies. However, given the worsening situation of climate change and natural capital/biodiversity, it is undeniable that we have reached a point where the ESG approach alone may not be sufficient. Hence, we will introduce corporate actions required in the "Beyond ESG Series" to address this evolving landscape.

In the first part, we explained the historical background leading to today's ESG and the changes in thinking and actions from both corporate and investor points of view. In this second part of the blog, based on these backgrounds, we will discuss whether companies are required to take action beyond the ESG approach, given the current critical state of our economic and social foundations.

Click here for Part 1, which considers the history of ESG and presents an overview of ESG, focusing on the social context in which the concept originated.

→ Beyond ESG Series: Universal Ownership and Corporate Behavior (Part 1)

Beyond ESG

Up to this point, we have looked back at the changes in SRI thinking that have been affected by historical and social changes, the emergence of ESG, information disclosure, and summarized the facts that pertain to climate change and natural capital/biodiversity issues becoming the most important ESG issues for both investors and companies.

However, nearly 30 years on from the Earth Summit, the impact of climate change has become more pronounced and changes in thinking from the investor side have started to emerge. This is the concept of Universal Ownership that we discussed in the first part. In particular, the impact of global climate change in recent years has become so pronounced that it is referred to as a "climate crisis", and a critical situation regarding natural capital/biodiversity has also surfaced as having a significant impact.

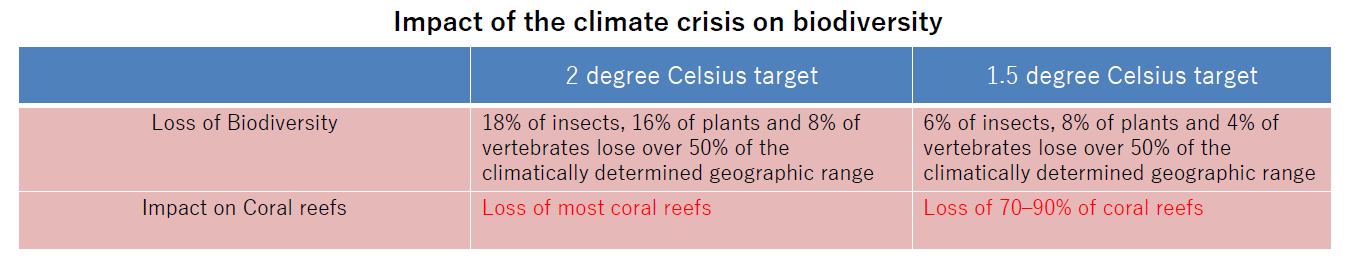

According to the special report on the impacts of global warming of 1.5℃ published by the IPCC*1 in 2018, it was predicted that 70% to 90% of coral reefs will be lost even if measures are taken to achieve the 1.5℃ target.

*1) Intergovernmental Panel on Climate Change, awarded the Nobel Peace Prize in 2007.

Source: Created based on the IPCC 1.5℃ special report

Source: Created based on the IPCC 1.5℃ special report

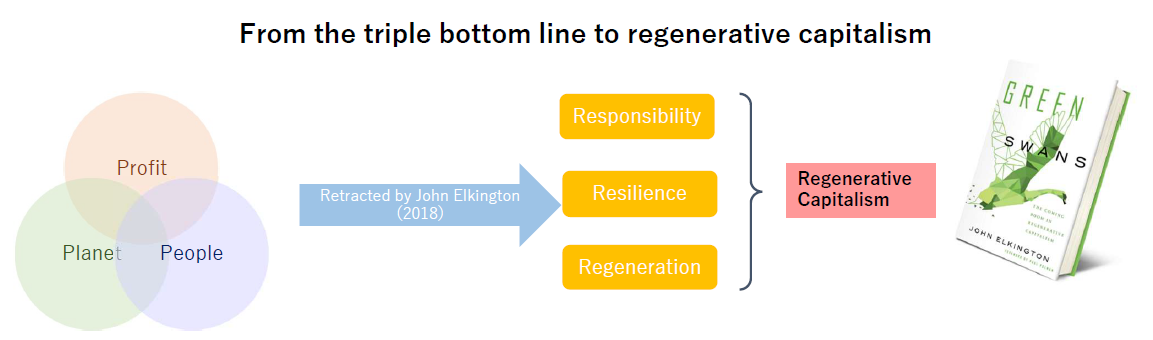

Under these circumstances, John Elkington, the proponent of the Triple Bottom Line, decided to retract it in 2018. The reason for this is that for many companies the Triple Bottom Line measures remained formalistic and did not lead to essential problem-solving. He argued that only this approach was no longer adequate and raised the factors of "responsibility", "resilience", and "regeneration". He suggested the need to transform the system of capitalism into "regenerative capitalism", and he expressed its advent with the term "Green Swan"*2.

*2) This concept of the “Green Swan” is different from the one published by the BIS (Bank for International Settlements), which refers to a new financial crisis triggered by climate change.

Source: Created by the author

Source: Created by the author

On the other hand, at COP27 held in 2022, Loss & Damage*3 was highlighted as a major theme for the first time, and an agreement was reached to establish a fund. It has been thought that the climate change issue should be dealt with mainly through the combination of mitigation and adaptation measures. However, in fact, the climate change should have been viewed from the beginning along three important points, including Loss & Damage, but it has not been raised as a central topic of discussion until now for political reasons*4. Given the above situation, both investors and companies need to assume that the foundation of society itself is in a critical situation when grasping the concept of ESG. On the other hand, from the perspective of SDGs, many companies still pretend to be environmentally aware, creating a breeding ground for greenwashing. However, if we return to the fundamental idea of the "Outside-In Approach"*5 required by the SDGs Compass*6, the ultimate goal should be the same as that derived from the concept of Universal Ownership.

*3) Measures and relief for losses and damages caused by the impacts of climate change.

*4) For historical reasons, it was of the greatest concern on the part of developed countries to lead talks of financial mechanisms from developed countries to developing countries.

*5) A goal-setting method that examines what is needed from a global perspective, sets goals based on this, and thus, companies fill the gap between the current level of achievement and the required level of achievement.

*6) An action plan for SDGs developed by three organizations: GRI, the United Nations Global Compact (UNGC), and the World Business Council for Sustainable Development (WBCSD).

Source: Created by the author

Source: Created by the author

What actions are companies required to take?

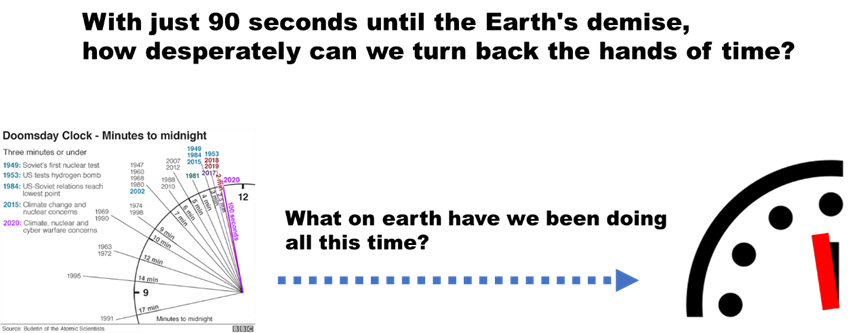

Over the past decade since the term ESG came to the forefront, but unfortunately, in that time, its foundation has been on the verge of collapse even further, as the “E” that includes global environmental issues has been increasingly overshadowed. If ESG investment is only a tool for companies to appeal to institutional investors to enhance corporate value, its effectiveness only to heal small scratches. The current deteriorating situation of global environment, however, goes far beyond such a level.

Source: Created by the author based on OECD materials

Source: Created by the author based on OECD materials

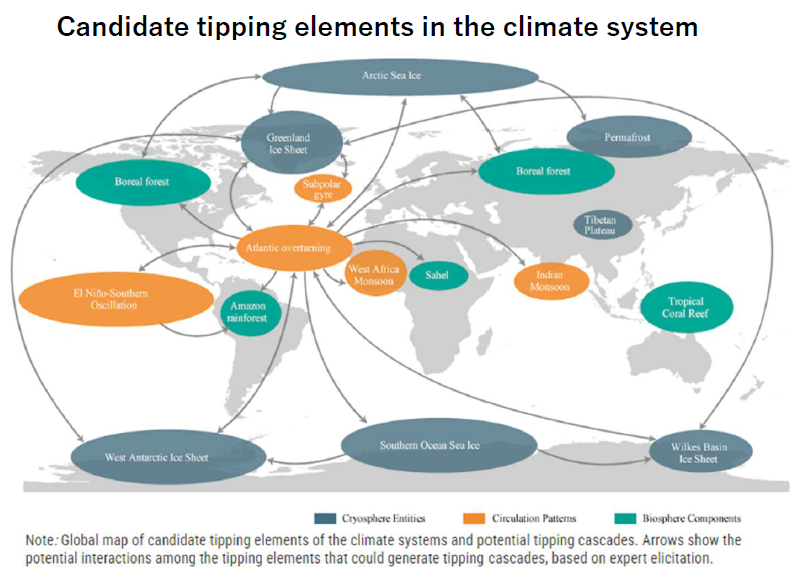

Moreover, we must not forget the existence of tipping points*7. Once these limits are exceeded, there is no turning back. Unfortunately, the worsening of the tipping elements is set to trigger a chain reaction. The fact that we are currently in a very serious situation is being highlighted by many scientists, including Johan Rockström*8, who leads the Earth League and proposed the concept of Planetary Boundaries*9, and Eric Lambin*10, a professor and department head at Stanford University.

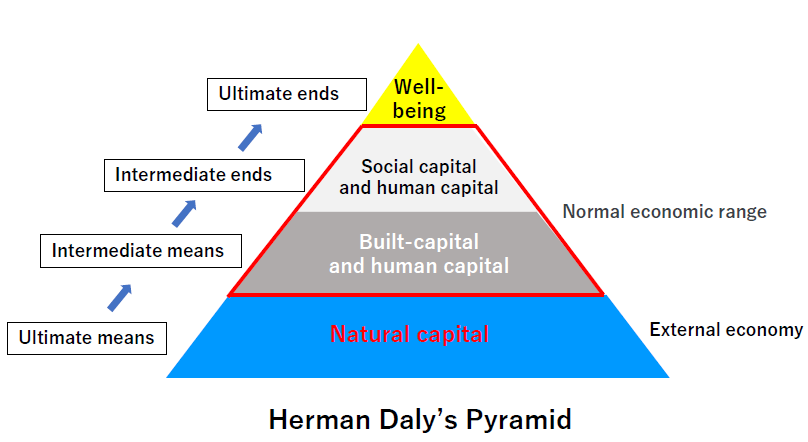

In short, the foundation of society (the Earth) where the economy operates is in a precarious state. If this foundation collapses, it will render the entire society and economy unworkable, as shown in Herman Daly's pyramid and the SDGs wedding cake.

*7) Tipping points refer to thresholds that cause qualitative and rapid changes in the elements that make up the Earth's climate. Tipping elements refer to large subsystems in the Earth system that seem to be exceeding their tipping points.

*8) A Swedish environmental scientist specializing in global sustainability and the director of the Potsdam Institute for Climate Impact Research. He is also known for proposing the concept of the SDGs Wedding Cake.

*9) Also known as Earth's limits or planetary boundaries, it is a concept that defines the area and limit points where humanity can survive.

*10) An environmental scientist from Belgium and the United States, also a professor at the Catholic University of Leuven. He has received awards such as the Blue Planet Prize, the Volvo Environment Prize, and the Francqui Prize.

Source: Created by the author based on Herman Daly's Pyramid

Source: Created by the author based on Herman Daly's Pyramid

Source: Stockholm Resilience Centre (2023)

Source: Stockholm Resilience Centre (2023)

The concept of Universal Ownership, which we discussed in the first part, is precisely born out of such circumstances. Although this is an idea originating from financial institutions, the core thinking behind it is something that all of humanity should be aware of. The Earth, which forms the foundation of human society, is already significantly damaged, and Gaia, the collective of all living creatures, is crying out for relief.

For the issue of climate change, there is an increasing call for an urgent crisis response, with statements being made like "the game is up by 2030" and "efforts by 2030 will determine the future state of the world". In the investment chain, including investors, information vendors, and rating firms, various corporate action evaluation-related initiatives are being launched. However, some of them seem to have their judgment criteria for corporate actions politically set or arbitrarily set to secure their own territory. Under such circumstances, both investors and companies are required to cultivate the ability to properly judge what actions are truly necessary now, as falling into the Evolutionary Trap*11 would result in it becoming too late.

Despite the critical situation of climate change and natural capital/biodiversity, events such as Russia's invasion of Ukraine and the outbreak of the Israel-Palestine war are still occurring. The actions required of companies nowadays are business expansions addressing ESG issues with a firm sense of purpose aiming to heal Gaia and lead to the restoration of its foundations, and with the conviction that the ultimate impact of companies' actions leads to the healing of Gaia beyond the ESG realm.

*11) Here it refers to the evolutionary trap that occurs when organisms make maladaptive decisions due to rapid environmental changes.

*This blog is created based on the views of the author and does not represent the company's unified views.

.png)

Beyond ESG Series: Universal Ownership and Corporate Behavior (Part 1) - Responding to Climate Change, Natural Capital, and Biodiversity

Writer:Ken Tammoto

MPhil of Development Studies from University of Cambridge, I am a former Program Officer at the United Nations Environment Programme (UNEP) headquarters in Nairobi, Kenya. After returning to Japan, I accumulated experience in various sectors, including government, banking, and securities-related think tanks. In 2022, I joined MOL as the Principal Strategist in the Energy Business Strategy Division. With over 30 years of involvement in climate change policy, my professional journey has been dedicated to addressing environmental challenges. While I have a wide range of hobbies, living without music is simply unimaginable for me.

Recommended Articles

2022.07.05

- General Shipping

2021.04.13

- Energy

2025.03.18

- General Shipping

2021.08.07

- Eco Friendly

Latest Articles

2026.02.02

- Eco Friendly

- General Shipping

2026.01.20

- Eco Friendly

- General Shipping

- BLOG

- Beyond ESG Series: Universal Ownership and Corporate Behavior (Part 2) - Responding to Climate Change, Natural Capital, and Biodiversity