BLOG

A Look Back at the United States-China Trade from 2020 to 2021

- Market Analysis

2022.02.21

“Phase One Deal” of the Economic and Trade Agreement between the United States and China, which was reached in January 2020, expired at the end of December 2021. Since the outbreak of COVID-19 in Wuhan, China, the two countries have been busy dealing with the COVID-19 situation at home, while repeatedly criticizing and confronting each other over how to respond to the outbreak. We will look back at the implementation of “Phase One Deal” and the trade between the United States and China over the past two years.

Status of Implementation of “Phase One Deal”

(January 2020 to November 2021)

In January 2020, the two countries agreed on “Phase One Deal” of an Economic and Trade Agreement. The agreement consists of seven chapters: (1) Intellectual Property (2) Technology Transfer (3) Agriculture (4) Financial Services (5) Currency (6) Expanding Trade (7) Dispute Resolution. Because this is the first agreement reached since the tariff war broke out in July 2018, the governments of both countries emphasized that the agreement was a "significant achievement". However, the agreement came at a time when China refused to drastically reconsider its domestic industrial policy, and the United States was still imposing punitive tariffs on about 70% of Chinese products, while sanctions and transaction prohibitions in the fields of advanced technologies such as digital and information communications were being further strengthened. It should also be remembered that the agreement was expected to be somewhat difficult to achieve from the outset.

The pillar of Phase One Deal includes a major expansion of the United States-China trade. China set the goal of increasing the import of various goods and services from the United States by $200 billion over the next 2 years ($77.7 billion in manufactured goods, $52.4 billion in energy products, $32 billion in agricultural and seafood products).

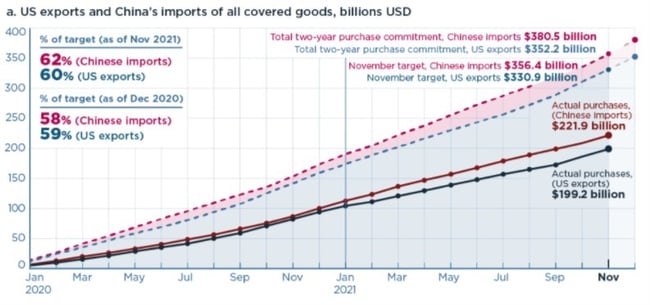

According to a Survey by the Peterson Institute for International Economics in the United States (as of the end of December 2021),China's total imports to the United States from January 2020 to November 2021 amounted to $221.9 billion, against a target of $356.4 billion. In addition, China's purchases of all covered products from the United States during the same period was expected to remain at 62% (Chinese imports), or 60% (exports from the United States) of Phase One Deal target.

Implementation of Phase One Deal:

Implementation of Phase One Deal:

China's Total Imports from the United States

-Target and Actual Figures-

Source: Peterson Institute for International Economics

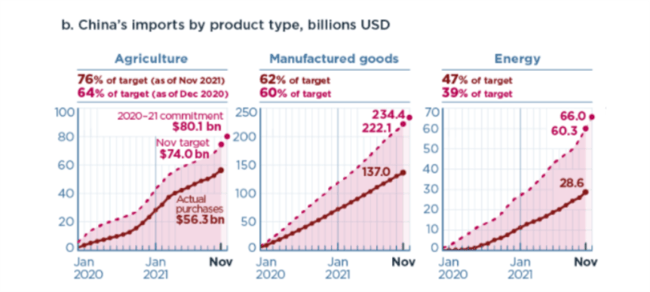

Next, we turn to China's imports from the United States over the same period by product category.

For agricultural products, China had planned to import $80.1 billion over the same period, but purchases of covered products were only $56.3 billion, 76% of the Phase One Deal target. For manufactured goods, they had planned to import about$234.4 billion, but only managed manufactured imports of $137 billion, 62% of the Phase One Deal target. For energy products, China had planned to spend about $66 billion, but ended up spending only $28.6 billion, 47% of its target.

Implementation of Phase One Deal -

Implementation of Phase One Deal -

Target and Actual Figures by product category

Source: Peterson Institute for International Economics

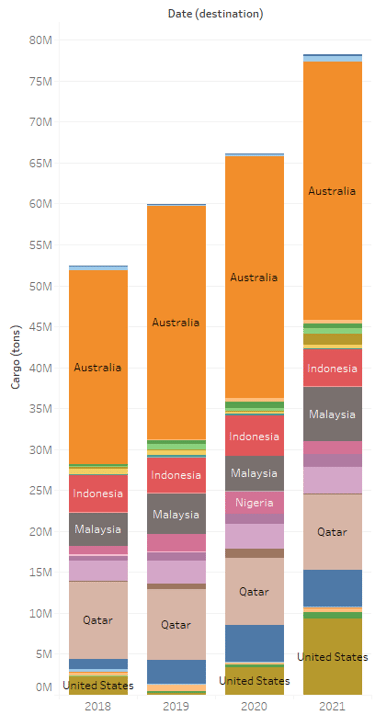

At present, however, China is rapidly increasing LNG imports (China surpassed Japan as the world's largest importer of LNG throughout 2021) in order to expand its use of clean energy and making up for power shortages. Given the large market potential, China's imports of U.S. LNG could see further increases.

China imports LNG mainly from Australia and Qatar. The volume of LNG imported from the United States had been on a downward trend since 2018 (2.3 million tons in 2018 and 300,000 tons in 2019) when trade frictions began to intensify, but it has increased sharply to 3.6 million tons in 2020 and 9.3 million tons in 2021. When it comes to import partners, in 2021 the United States ranked second after Australia, which ranked first with 31 million tons.

Imports of U.S. crude oil from 2020 to 2021 were 659.2 kbd, doubling from 305 kbd during 2018 and 2019.

China LNG Imports by Country 2018 -2021

Source: IHS Markit - Created by MOL

In addition, imports of soybeans from the United States, which attracted much attention due to the tariff war, increased significantly from 16.6 million tons in 2018 to 26.2 million tons in 2021.

Click here for the blog of “The United States-China Trade Confliction in terms of soybean cargo movements”.

Outlook for 2022

As of November 2021, despite it proving difficult to achieve the goal of expanding trade between the United States and China, at the US-China Summit one of the key themes was to make "progress in discussions on economic issues, including the implementation of the US-China Economic and Trade Agreement (Phase One Deal) ". As the Biden administration's focus on China has shifted from correcting trade imbalances to responding to economic security-related risks, it is thought that the focus of discussions is likely to shift to a "Phase Two Deal" covering subsidies to Chinese domestic industries.

Even after the inauguration of the Biden administration, the mainstream view was that the Trump administration's hardline policy toward China would continue and tensions between the United States and China will continue for longer than expected. While recognizing the protracted conflict structure of strategic interests between the United States and China, the U.S. industry believes that economic and trade interdependence benefits the U.S. economy, industry and other sectors, and is calling on the Biden administration to negotiate solutions to structural and other problems in China and to seek a reduction or elimination of additional tariffs imposed on the products of both two countries as sanctions.

In October 2021, the United States announced that it would reintroduce its tariff exclusions process for China as a measure to reduce the burden of buying imported goods in response to accelerating inflation in the country. There is no doubt that the two countries are "important trading partners" to each other, so with the global supply chain becoming disrupted due to the COVID-19 outbreak, it will be interesting to see how the United States and China can reach a compromise after the planned implementation period of “Phase One Deal” comes to an end.

Although the targets of “Phase One Deal” have not been achieved,

Although the targets of “Phase One Deal” have not been achieved,

the volume of trade has increased.

Source: GZERO media the Graphic Truth: Is the US-China trade war over? "

Since the exchange of additional tariffs between the United States and China began in 2018, the clash between the two superpowers has become a common theme when discussing global economic trends. At the beginning of the Top 2022 Risks report released recently by Eurasia Group, it was said that while the United States and China are not in a Cold War situation, the top concerns were related to the United States and China relationship.

In 2022, China will host Beijing Olympics in February and the National Congress of the Chinese Communist Party, which is held once every 5 years, will take place in the fall. In the United States, meanwhile, midterm elections are scheduled to be held in November, forcing both countries to devote considerable resources to domestic policies. Tensions are expected to continue in their non-negotiable "Battle for hegemony," while building cooperative relations on issues such as climate change. The impact of a change in the balance between the United States and China should be closely watched.

Writer:Masumi

She joined in 2002.She is experienced in secretary to the president, bulk carrier operations, HR division. She is in charge of the market research from 2018.Always looking forwards to finding the ways to help our service go beyond the world! Her favorite food is Japanese traditional sweets.

Recommended Articles

2022.07.05

- General Shipping

2021.04.13

- Energy

2025.03.18

- General Shipping

2021.08.07

- Eco Friendly

Latest Articles

2026.02.02

- Eco Friendly

- General Shipping

2026.01.20

- Eco Friendly

- General Shipping