BLOG

COVID-19 and Tanker market turbulence

- Market Analysis

2023.01.16

In October 2020, we reported on the extraordinary surge in the tanker market caused by COVID-19 (see: Why the tanker market was boosted by COVID-19)

COVID-19 continues to have a major impact on the world economy and society, but our daily lives are gradually returning to normal.

With the normalization of our daily lives, oil demand, which once declined sharply, recovered to pre-pandemic levels in about two years. Meanwhile, the tanker market, which had been boosted due to temporal demand for offshore oil storage, soon plummeted. Thereafter the market remained extremely low, with no profit for tanker operators.

In this article, we will describe the "after" events of world oil supply and demand and oil transport which had been severely disrupted by the COVID-19 pandemic.

Decline and Recovery in oil demand

Due to the movement restrictions and the lockdown of many cities caused by the pandemic, oil demand fell sharply in 2020, particularly for transportation fuels such as gasoline, diesel, and jet fuel, falling by 15% year-on-year in the second quarter of 2020. On the other hand, despite coordinated oil production cuts by OPEC plus, oil production was not able to immediately respond to a sharp decline in demand, resulting in a significant oversupply, as shown in the chart below.

The massive oversupply of oil led to a rapid fall in crude oil prices, on April 20, 2020, for the first time in history, the price of U.S. WTI crude oil, which is the benchmark price for international crude oil trading, recorded a negative price, an extraordinary situation.

However, as can be seen in the chart above, oil demand has since steadily increased as movement restrictions eased and economic activity normalized around the world. By the fourth quarter of 2021, less than two years after the Wuhan lockdown in China, demand had finally recovered to pre-pandemic levels. At the same time, supply and demand are generally balanced in the current oil market, with OPEC plus continuing to cut oil production to date.

Increased Oil Stocks and Offshore Storage

In March 2020, after a series of worldwide city lockdowns, oil that had nowhere else to go due to the sharp decline in demand would build up as stocks in oil tanks around the world. Moreover, oil that could no longer fit in onshore tanks had to be stored offshore in large tankers arranged as "temporal oil tanks."

In fact, from March to May 2020, many tankers were used as offshore oil storage, as they were forced to wait long periods at their cargo destinations due to a lack of space in onshore tanks. One shipping market research firm says that at its peak, nearly 100 of the world's 800 large oil tankers known as VLCCs* were being used as offshore storage instead of for oil transportation.

Photo: U.S. Coast Guard (April 23, 2020)

Many tankers anchored off the Port of Long Beach, Los Angeles, USA

However, as shown in the above graph, the oil inventory that had built up to an all-time high eventually returned to pre-pandemic levels in the second quarter of 2021 due to a recovery in oil demand and continued OPEC plus coordinated oil production cuts. As onshore tanks became available, the tankers anchored offshore with their cargoes on board gradually ended their role as offshore storage and returned to usual oil transportation voyages.

*VLCC: Very Large Crude Oil Carrier. A large crude oil tanker is capable of transporting about 300,000 tons (2 million barrels) of crude oil at a time.

See "How large is the Very Large Crude Carrier?" for more information about VLCCs.

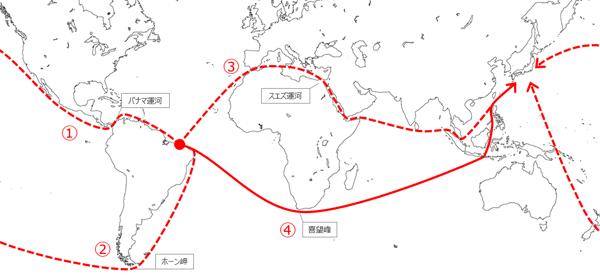

Supply chain and Maritime transport of Oil

Crude oil produced in the oil fields of oil-exporting countries is transported to oil refineries around the world by pipelines or crude oil tankers. At oil refineries that receive crude oil, various petroleum products such as gasoline, diesel, kerosene, and jet fuel are refined and transported again to the consuming areas of each product by product tankers and tank trucks. And then, these oil products are delivered to us through retail stores.

Source: Petroleum Association of Japan: Petroleum Industry in Japan 2020

The figures shown above are those in Japan.

In the supply chain, in 2019, maritime transportation of crude oil (from oil-exporting countries to refineries) was approx. 2.02 billion tons, while maritime transportation of petroleum products (from refineries to consuming areas) was approx. 1.08 billion tons. To meet the transportation demand for these oils, numerous tankers navigated the world's oceans day by day.

In 2020, however, the demand for oil transportation fell sharply due to the decline in oil demand, and tankers, having completed offshore storage, suffered a decline in the amount of cargo to be transported, even though they returned to their usual voyages.

The recovery in oil transportation demand will come after onshore inventories have well drawn down, which was not significant in 2021, and the slump in the tanker market has prolonged.

Turbulence in the tanker market

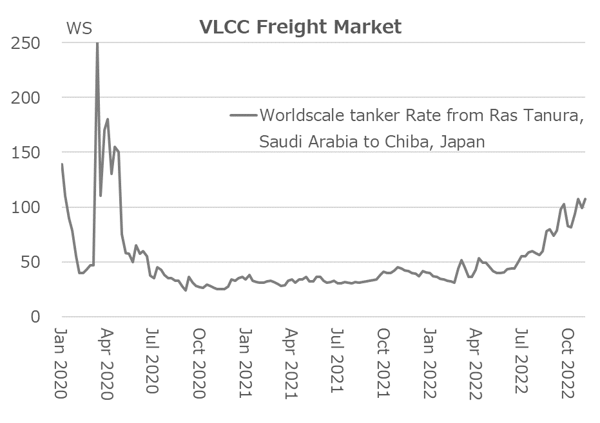

The tanker market fluctuated wildly due to the disruption to oil demand and oil transportation demand caused by the COVID-19 pandemic.

In March 2020, when the availability of onshore oil tanks ran out, demand for offshore stockpiling by tankers increased and the tanker market quickly soared to near all-time highs. However, the market surge did not last long and soon fell to an all-time low as the offshore storage demand began to ease.

And then, the tanker market was to suffer an extraordinary slump for the next two years, as the decline in demand for oil transportation continued, with no profits at all from transporting cargoes (in fact, transporting cargoes will incur losses to operators).

While it is clear that the surge in the tanker market caused by turmoil in oil demand and oil transportation was unsustainable, it is also unsustainable that tankers do not make any profits even if they transport the oil. We hope that the world economy and society will remain stable, and freight rates also remain stable at an appropriate level, so that the operation of cargo vessels, which support our daily lives, becomes sustainable.

MOL’s tanker fleet continues to operate in the world's oceans as experts in liquid cargo transportation, supporting the world's energy needs and our daily lives.

For more information on MOL’s tanker fleet

https://www.mol.co.jp/en/services/tanker/

Writer:Takahiro

Joined the company in 1991. A man in his 50s has experienced in dry bulk shipping, crude oil and petroleum product tanker shipping, and fuel oil procurement for our operated ships before he transferred to market research. Recently he gains excess belly fat probably because he had been involved in oil-related businesses for a long time...

Recommended Articles

2022.07.05

- General Shipping

2021.04.13

- Energy

2025.03.18

- General Shipping

2021.08.07

- Eco Friendly

Latest Articles

2026.02.02

- Eco Friendly

- General Shipping

2026.01.20

- Eco Friendly

- General Shipping